It's been 50 years since we've seen bell bottoms, tinted eyewear, sweater vests or serious concerns about a stagflation driven economy. But they all may be making a comeback.

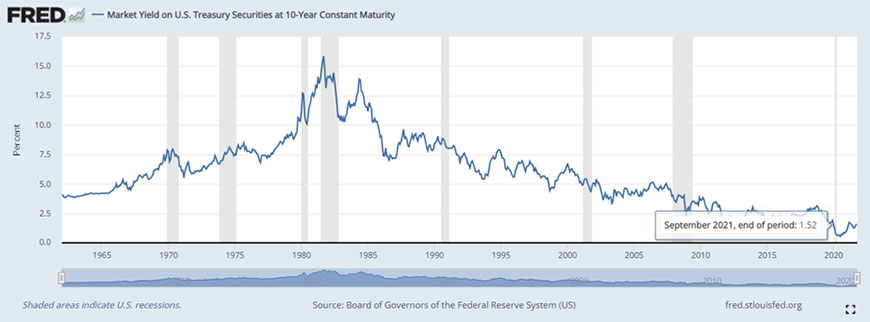

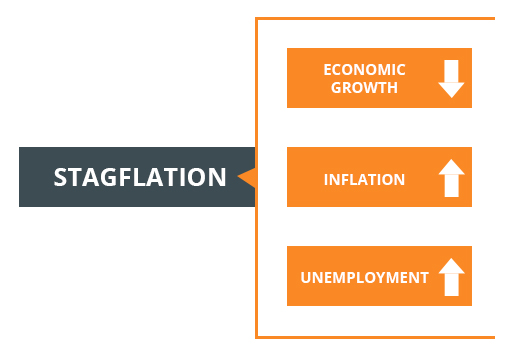

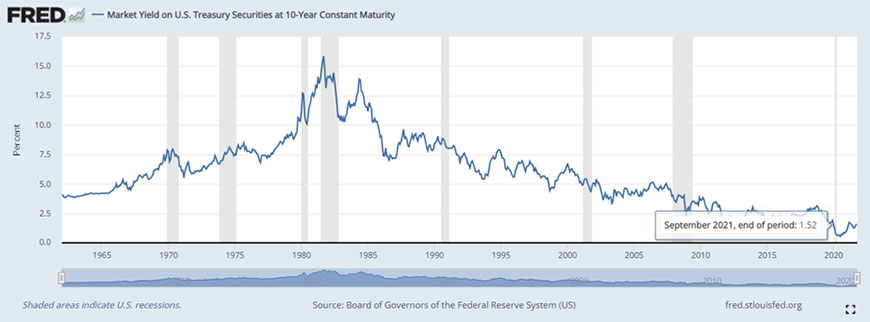

The stagflation phenomenon — which describes a period of high inflation, high unemployment and low economic growth — is always a difficult period for Fed policymakers, because they are left with few options to rein in higher prices without dramatically slowing the economy. From the late 1970s to the early 1980s, Federal Reserve Chair Paul Volcker was ultimately forced to raise interest rates to unprecedented levels to bring inflation under control, which had the effect of severely curbing economic growth during the period.

https://fred.stlouisfed.org/series/DGS10

Five decades later, talk of stagflation is back. Have today's investors even heard of stagflation, much less do they understand it? We doubt it, so we've broken it down. Stagflation is defined by low growth coupled with high inflation and high unemployment. Sadly, there is no definition of "low" or "high". So we'll define low and high as "uncomfortable levels," potentially causing action from the government or Federal Reserve officials to counter them.

One can make a case that moderate stagflation has already arrived. Growth, as measured by GDP, appears to be moderating (although perhaps not yet low). Inflation, as measured by the Fed's preferred "Personal Consumption Expenditures" price index (PCE), is rising (although perhaps not yet high). And unemployment has been stubbornly persistent and may begin climbing again (although perhaps not yet high).

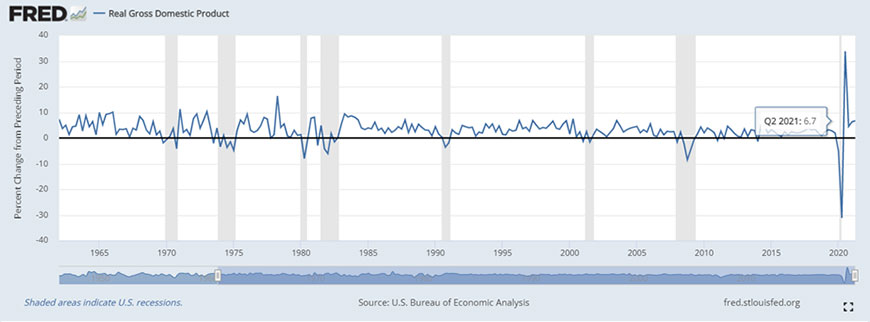

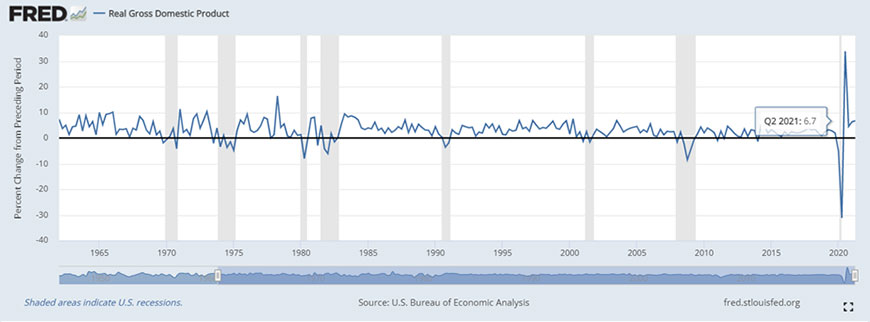

Growth

Economic growth has recently been hindered because of the Delta variant. We have observed that economists are downgrading predictions for economic growth over the next few quarters – a departure from the prediction of a "pent-up-demand" explosion we had all anticipated.

In the previous stagflation period from 1979 through 1982, GDP hung around 0.0%, sometimes fluctuating wildly on either side of the flat line. Over the past 2 years, the Covid 19 pandemic brought about the largest negative GDP results in history, which was quickly recovered. Growth has remained strong through Q2 2021 at 6.7%. However, as mentioned above, projections for future quarters are lowering as the pandemic continues to impact our economic lives.

https://fred.stlouisfed.org/series/A191RL1Q225SBEA

https://fred.stlouisfed.org/series/A191RL1Q225SBEA

Any uncertainty in tomorrow, next week or next month gives the consumer a reason to wait and not spend. However, we do see growth that was projected in the second half of this year not being lost forever but instead delayed into 2022.

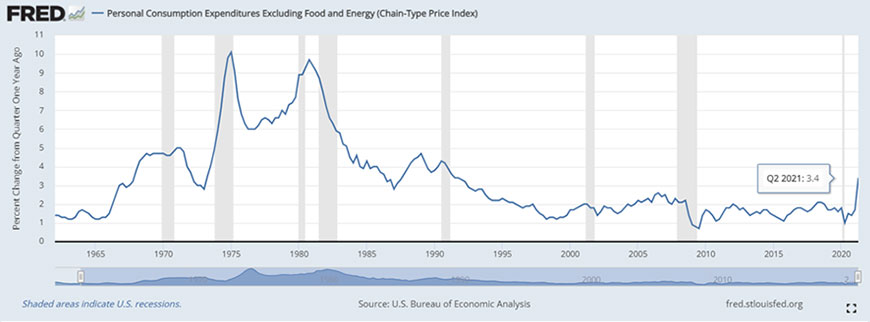

Inflation

For months, prices have been rising as the U.S. economy has recovered from the COVID pandemic and central banks have clung to the view that elevated inflation would be "transitory" and likely subside. But a recent government report showed U.S. inflation hit a 30-year high as of August

(1). Central bankers appeared to begin capitulating this week, with Federal Reserve Chairman Jerome Powell saying that high inflation could run into 2022.

Inflation could encourage workers to demand higher wages and employers would have no choice in order to fill persistent job openings. If consumers are paid more, their purchasing power grows, and businesses may raise prices as demand accelerates — to cover the higher wages they were forced to pay — starting the entire cycle of inflation pressures over-again.

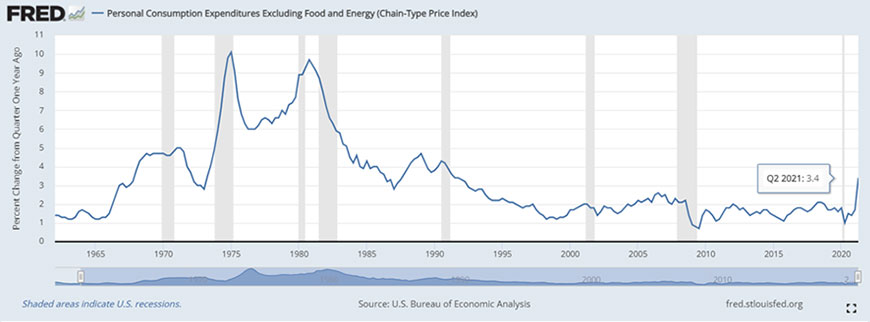

During the previous stagflation period from 1979 through 1982, inflation was consistently above 6%, reaching as high as 9.7% at the end of 1980. Over the past 2 years, inflation was low during the start of the pandemic but reached its highest level since 1991 during Q2 2021 at 3.4%. That's not yet high, but it's relatively higher than recent years and the trend appears to be increasing.

https://fred.stlouisfed.org/series/BPCCRO1Q156NBEA

https://fred.stlouisfed.org/series/BPCCRO1Q156NBEA

Demand pushing forward will keep inflation pressures higher for longer but not for a period which we would consider substantially longer than transitory (i.e., 12-18 months). We believe supply chains will naturally fill in, and inflation pressures will abate as demand is never endless and neither are consumers' wallets.

Unemployment

The Delta variant of the coronavirus led to a second straight month of disappointing job growth as the Labor Department reported on October 8th that U.S. employers added 194,000 jobs in September. The 194,000 jobs added in September was down from 366,000 in August and far below the more than one million jobs added in July, before the more contagious Delta variant led to a spike in coronavirus cases across much of the country. The leisure and hospitality sector, which had been a main driver of job growth before Delta emerged, added fewer than 100,000 jobs for the second straight month

(2).

During the previous stagflation period from 1979 through 1982, unemployment ranged from just under 6.0% to as high as 10.8% at the end of 1982. Over the past 2 years, the Covid-19 pandemic brought an initially dramatic spike in unemployment that, fortunately, quickly reversed itself. September 2021's 4.8% unemployment rate feels acceptable, but as indicated above, job growth is slowing and the unemployment trend could move the other way.

https://fred.stlouisfed.org/series/UNRATE

https://fred.stlouisfed.org/series/UNRATE

By natural selection, outdated jobs will be replaced with more contemporary roles within the labor force. With the development of more work from home and hybrid positions, these jobs can be less interrupted by future Covid variants. We wrote in

last month's Special Market Update that the post-pandemic economy will not resemble the pre-pandemic economy and no place will that be more felt than in the job market. However, a rotation of jobs takes time and job seekers get new training for new careers, this transformation in the job market could take years to resolve.

Conclusion

Are we moving into a period of stagflation?

It's the Investment Committee's role at WT Wealth Management to pay close attention to what's unfolding throughout the economy in order to best position our clients for the months ahead. When we can explain what we are seeing in easy to digest snippets or memorable terms, we attempt do so.

The combination of some lost 2021 GDP growth delayed into 2022 and supply chains filling in during the middle or 2nd half of 2022 will allow for continued inflation pressures throughout the economy as we enter the first half of 2022. Persistent inflation pressures could cause the Federal Reserve to act sooner to raise interest rates than previously anticipated.

However we believe the Federal Reserve will remain incredibly patient so as not to upset the current economic expansion under way. The combination of U.S. inflation moderating in late 2022 and economic growth improving with a more fully vaccinated and adaptive population should allow for more traditional economic picture in late 2022 and beyond.

Early hints of possible stagflation are out there - although nowhere near the levels seen from 1979 to 1982. It's something worth tracking, but not something we're overly concerned about in the near term. Nevertheless, we'll keep our eyes peeled for you.

FOOTNOTES:

- Key inflation gauge watched by the Federal Reserve hits another 30-year high

cnbc.com

- September's jobs creation comes up short with gain of just 194,000

cnbc.com