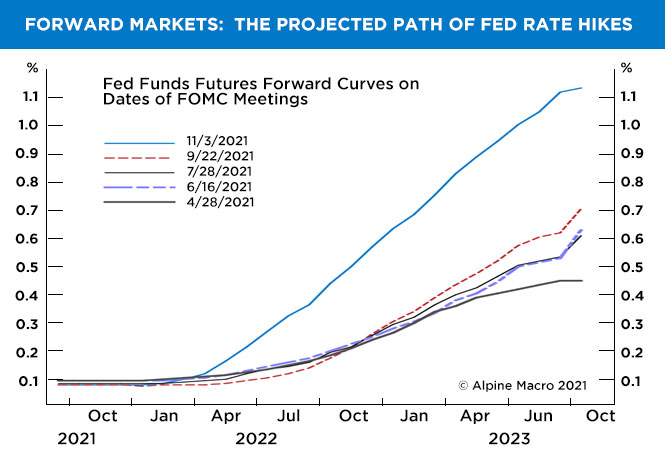

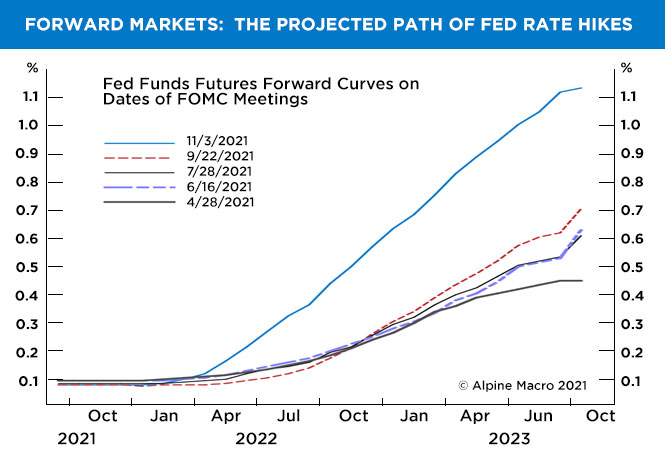

News Alert! Interest rates will increase in the coming months and years.

There, I said it. After the Financial Crisis of 2008 it took the Federal Reserve SEVEN years (Dec 2008 to Dec 2015) to make their first increase to the Federal Funds Rate (FFR), moving first from a range of 0.00-0.25 to 0.25-0.50. Over the next 3 years -- through December 2018 – the Fed managed to increase the FFR to a range of 2.25-2.50 through 9 measured rate increases. This process is commonly referred to as rate normalization.

For historical perspective the FFR from 1994 to 2001 never was below 4.75% and reached 6.00% on several occasions.

Now today, after the Covid pandemic, when the Fed slashed rates to 0.00-0.25 yet again in March of 2020, we find ourselves at another all-time low, looking ahead to next summer when most economists believe the Federal Reserve will once again begin the long campaign of rate normalization. As inflation pressures have recently increased, most economists are now predicting the Fed will move even more quickly than was thought just 90 days ago (the increased tapering announcement is a precursor to such moves).

Source: Chicago Mercentile Exchange

What Is the FFR?

The term Federal Funds Rate, or FFR, refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight. The FOMC is responsible to set the target federal funds rate as part of its monetary policy. Monetary policy is used to help promote, control and even at times constrict economic growth. The FFR is the only part of the yield curve that the Federal Reserve directly controls.

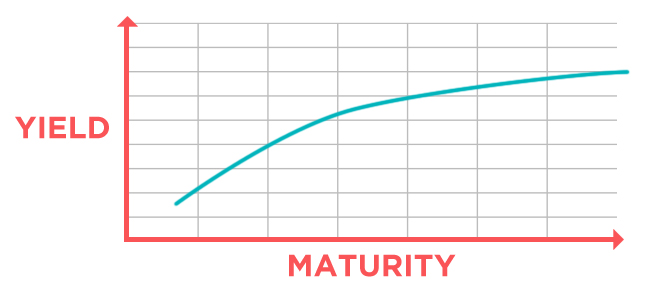

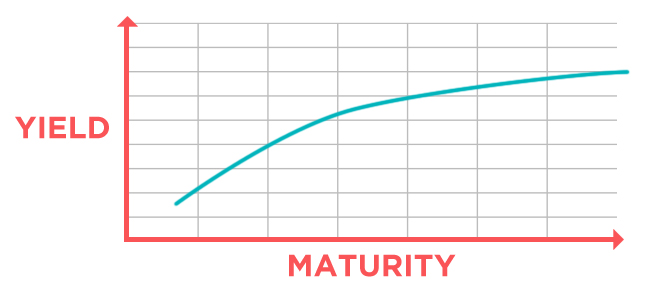

1

As the yield on the short end of the interest rate curve (i.e., the overnight rate) is pushed higher the maturities behind it (i.e., 3-month, 6-month, 2-year, 10-year, 30-year, etc.) also increase in yield. Generally, the longer an investor is willing to wait for a bond to mature, the more they are rewarded with increased yield. This is not unlike any other fundamental of investing where you are rewarded for risk. And yes, going farther out in years on the curve is taking on additional risk as you are waiting longer for your money.

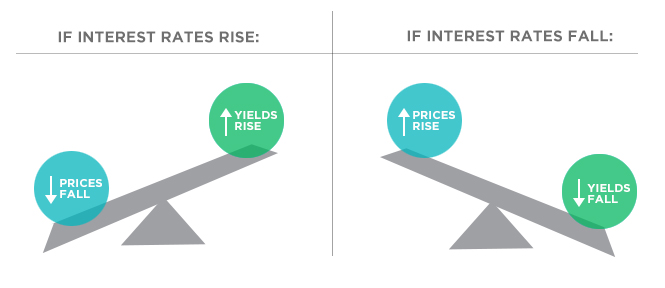

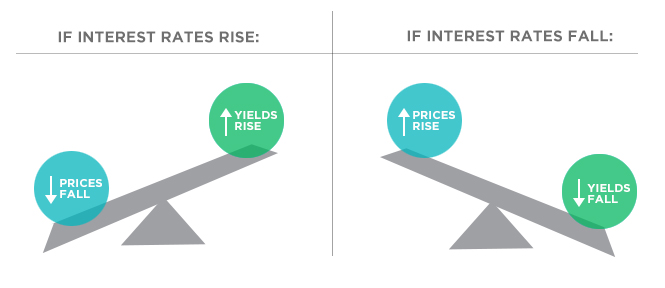

There is a common perception among many investors that bonds represent the safer part of a balanced portfolio and are less risky than stocks. While bonds have historically been less volatile than stocks over the long term, they are not without risk. Treasury bonds (as well as other types of fixed income investments) are sensitive to interest rate risk, which refers to the possibility that a rise in interest rates will cause the value of previously issued bonds to decline. Bond prices and interest rates move in opposite directions. When interest rates fall, the value of a bond previously issued at a higher interest rate will rise. When interest rates rise, the valued of a bond previously issued at a lower interest rate will fall.

Source: Everything You Need to Know About Bonds – global.pimco.com

If rates rise and you sell a bond held in your portfolio prior to its maturity date (the date on which your investment principal is scheduled to be returned to you), you could end up receiving less in exchange than what you originally paid for your bond. Similarly, if you own a bond fund or bond exchange-traded fund (ETF), its net asset value will decline if interest rates rise. The degree to which values will fluctuate depends on several factors, including the maturity date and coupon rate on the bond or the bonds held by the fund or ETF.

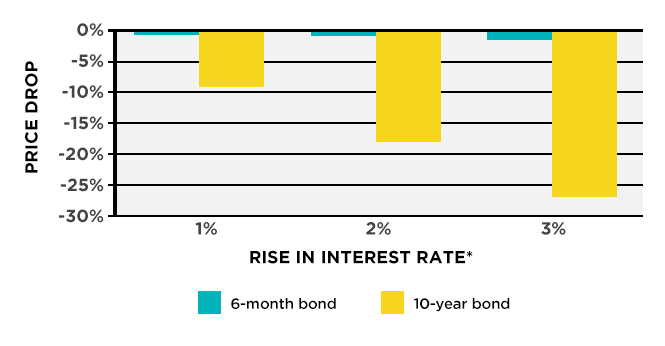

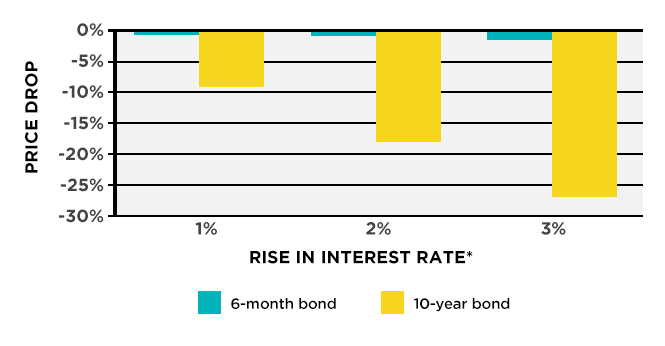

Using a bond's duration to gauge interest rate risk

Investment professionals closely examine a bond's "duration" – a measure that combines several bond characteristics (such as maturity date, coupon payments, etc.) into a single number that indicates how sensitive a bond's price will likely be to interest rate changes. Generally, bonds with long maturities and low coupons are more sensitive to a change in market interest rates and thus are more volatile in a changing rate environment. Conversely, bonds with shorter maturity dates or higher coupons will be less sensitive to changing rates and thus are less volatile in a changing rate environment.

The chart below shows how a bond with a 5% annual coupon that matures in 10 years (yellow bar) would fall more in price as interest rates rise than a bond with that same 5% coupon but only 6 months left to maturity (blue bar). Why is this so? Because bonds with shorter maturities return investors' principal more quickly than long-term bonds do. Therefore, they carry less long-term risk because the principal is returned, and can be reinvested, earlier.

Source: Fidelity.com Learning Center

Of course, duration works both ways. If interest rates were to fall, the value of a bond with a longer duration would rise more than a bond with a shorter duration. Therefore, in our example above, if interest rates were to fall by 1%, the 10-year bond would rise in value by approximately 9%. If rates were to fall 2%, the bond's value would also rise by approximately twice as much (18%).

2

Conclusion

While higher interest rates will be great news for retirees and any less risk tolerant investor in a more diversified 70/30, 60/40 or 50/50 portfolio, it can be a rough and bumpy road as the Fed works to increase rates. Increasing rates will result in declining prices for the safe, risk off portion of an investor's portfolio. This occurs at the same time that equities, the risk on portion, are also struggling to effectively compete against the now higher interest rates. The result?. . . investors may feel caught between a rock and a hard place as the Fed tightens economic conditions.

The good news is that these difficult rate hiking campaigns tend to normalize over several quarters – a relatively short time period – and the equity markets rediscover their traditional direction upward and to the right.

At WT Wealth Management it's our job to keep you informed and that's the purpose of this paper. While we do believe interest rate normalization is ultimately healthy for the economy, it can be uncomfortable getting there. Please reach out to your advisor if you would like to discuss more. We're happy to help.

Footnotes:

- Federal funds rate

wikipedia.org

- Duration: Understanding the relationship between bond prices and interest rates

fidelity.com