This month we wanted to talk about a special case circumstance – whether you are a new client just beginning to invest or an existing client with newly available cash: If you find yourself the beneficiary of a sudden windfall, you'll be faced with a classic investing dilemma:

- Invest the entire windfall immediately – "Lump Sum Investing" or LSI

or

- Invest the windfall at regular intervals over a longer period of time – "Dollar Cost Averaging" or DCA

Which is the more appropriate strategy? The answer isn't always obvious and requires balancing historical data with your personal tolerance for risk.

Historical Data Says LSI

A recent study from Northwestern Mutual Wealth Management shows an investor is more likely to end up with a higher account value in the future by choosing Lump Sum Investing.

(1)

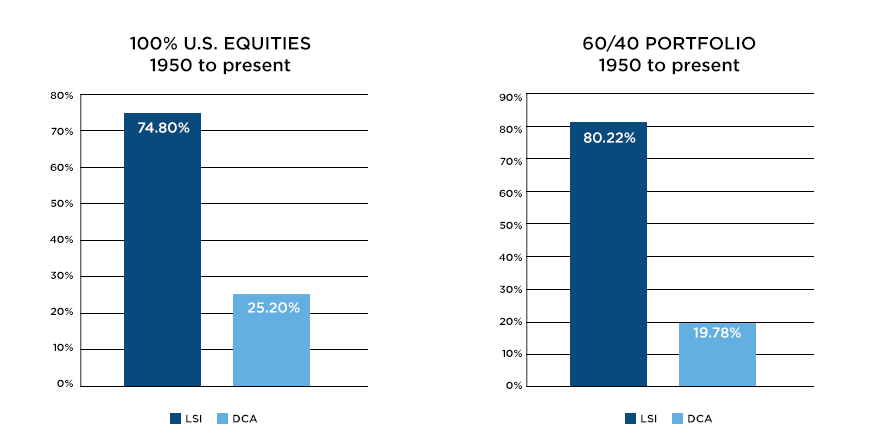

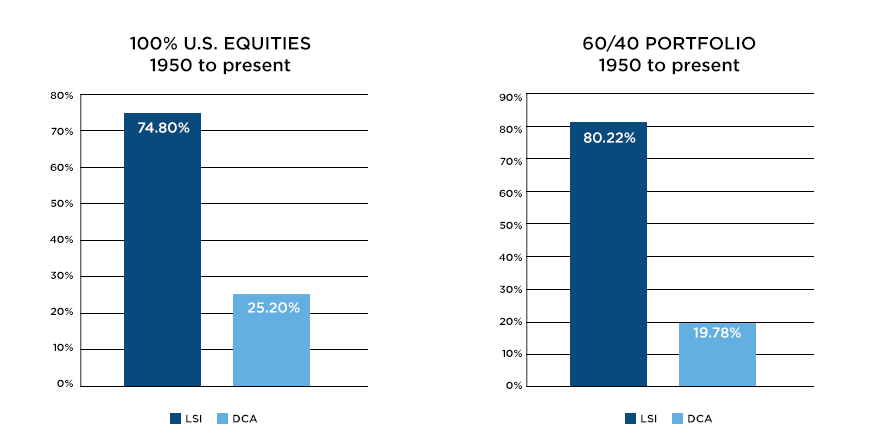

The study (analyzing the period ranging from 1950 to the present) looked at rolling 10-year returns on $1 million invested in two common portfolio allocations (100% stocks versus 60% stocks / 40% bonds) either in LSI or DCA strategies. The charts show how often LSI provided the greater return and how often DCA provided the greater return.

Hypothetical analysis for illustration purposes only assumes equity and bond allocations are invested in an "all-market" U.S. equities or U.S. bond index.

For the LSI method, all $1 million is invested on day one and held for 10 years.

For the DCA method, 1/12th of $1 million is invested each month for 12 months and then held for the remaining nine years.

Rolling returns, also known as "rolling period returns" or "rolling time periods," are annualized average returns for a period, ending with the listed year.

Assuming a 100% stock portfolio, the return on lump-sum investing outperformed dollar-cost averaging 75% of the time. For a portfolio composed of 60% stocks and 40% bonds, LSI's outperformance rate was 80%. So clearly, this study shows that lump sum investing resulted in better returns than dollar cost averaging a large percentage of the time.

Why does this happen? It's simply a manifestation of the long-term relationship between risk and return. Higher levels of risk demand higher expected returns. So a 100% equity portfolio has a higher expected return than a 60/40 diversified portfolio, which has a higher expected return than cash holdings.

Stocks and bonds compensate investors for taking risk by way of dividends, interest and price appreciation. Cash, on the other hand, is almost no risk and provides little return, if any at all. By definition, an LSI strategy holds less cash over its life than a DCA strategy. Therefore, it is no surprise that, over time, LSI strategies have historically outperformed DCA strategies.

(2)

Essentially, the Northwestern Mutual Wealth Management data supports the familiar adage: "Time in the market beats timing the market".

Your Personal Tolerance for Risk May Say DCA

Based solely on historical data, DCA would seem to be an inferior strategy to LSI for investing a windfall. But performance is just one of many factors an investor should consider before putting money to work in markets. An individual investor's stress levels and emotional well-being in a given market environment can be just as important as portfolio performance. So let's not count DCA out completely.

All the historical data in the world won't make it feel any better in the moment to see a windfall decline 5%, 10%, 15% or 20% in a short period of time. And as we've highlighted in previous articles, that occurrence is relatively common in financial markets.

If financial markets make you nervous and you aren't entirely comfortable putting your windfall at risk, dollar cost averaging is one way to participate in markets at your comfort level by slowly deploying capital.

Conclusion

Over the years, we have learned that having a plan and letting data guide your decision making is the best way to be positioned for success in investing.

If you're focused on capital appreciation and can ignore a little volatility, lump sum investing tends to outperform dollar cost averaging over the long-term. However, if markets make you nervous, it may make more sense to use dollar cost averaging as a way to acquaint yourself with market volatility. That's at least better than avoiding financial markets altogether. That being said, if markets make you nervous, perhaps you should simply recognize yourself as a more conservative investor and seek out strategies that have lower levels of risk.

Ultimately, investment advisement and personal financial planning aims to strike a balance between performance, investment goals, and tolerance for volatility. Investing is a highly personal endeavor. There is no single solution for every investor. If you're fortunate to be on the receiving end of a sizable windfall, it makes a lot of sense to speak to your financial advisor to strategically manage those funds in a way that works best for you.

We're here to help. Please reach out whenever you need us.

Sources

- Is Dollar-Cost Averaging Better Than Lump-Sum Investing?

NorthwesternMutual.com

- The Reality of Investment Risk

FINRA.org