A Brief Overview

The University of Michigan's Consumer Sentiment Index and

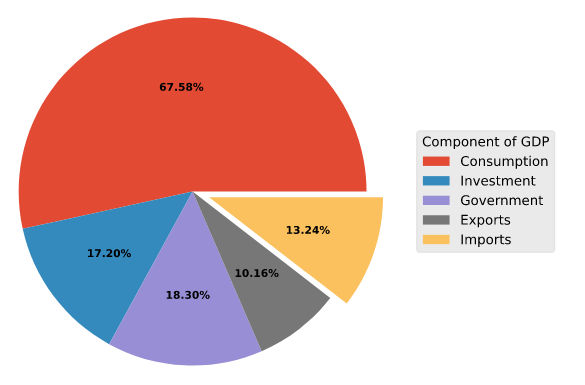

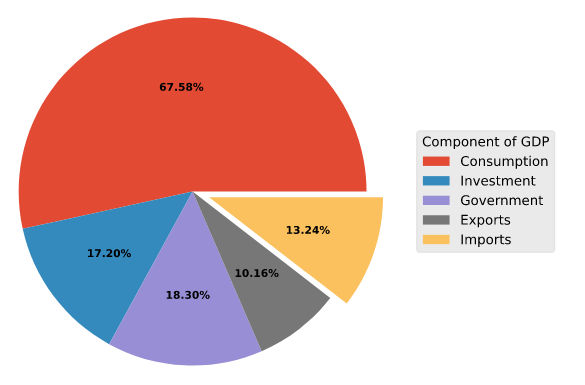

The Conference Board's Consumer Confidence Index – two of the most watched monthly economic indicators - are based on surveys that aim to understand and track the mood of the American consumer, thus helping economists gauge the mentality of the U.S. consumer and their outlook on the economy. According to the Federal Reserve, personal consumption accounts for nearly 70% of U.S. GDP, so it's understandable that the mood of the "American Consumer" is a constant source of interest to all investors.

https://ecoindica.com/post/first-post/

Consumer Confidence

The Consumer Confidence Index (CCI) is published by The Conference Board, a not-for-profit research organization for businesses. The survey is a sample of 3,000 households from across all nine U.S. census regions

The survey usually covers five major aspects of consumer confidence:

- Current business conditions

- Business conditions for the next six months

- Current employment conditions

- Employment conditions for the next six months

- Total family income for the next six months

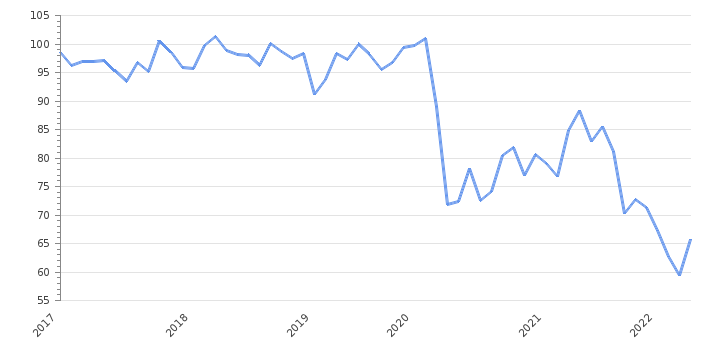

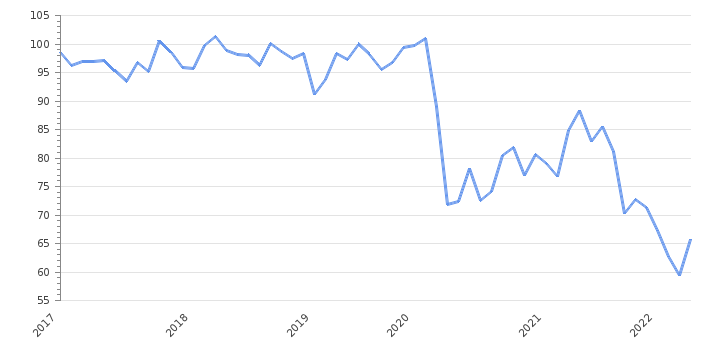

The following chart, showing 5 years of consumer confidence measures, indicates we have recently reached new lows as Americans worry about lingering effects of the Covid-19 pandemic, inflation and the war in Ukraine.

https://take-profit.org/en/statistics/consumer-confidence/united-states/

Consumer Sentiment

The Consumer Sentiment Index (MCSI) is a national survey of 500 households conducted by the University of Michigan. The purpose of the survey is to collect information about consumer expectations regarding the overall economy.

The MCSI covers a broader range of seven consumer sentiments:

- Current Economic Index

- Personal Finances Current

- Buying Conditions Durables

- Expected Economic Index

- Personal Finances Expected

- Business Conditions 1 Year

- Business Conditions 5 Years

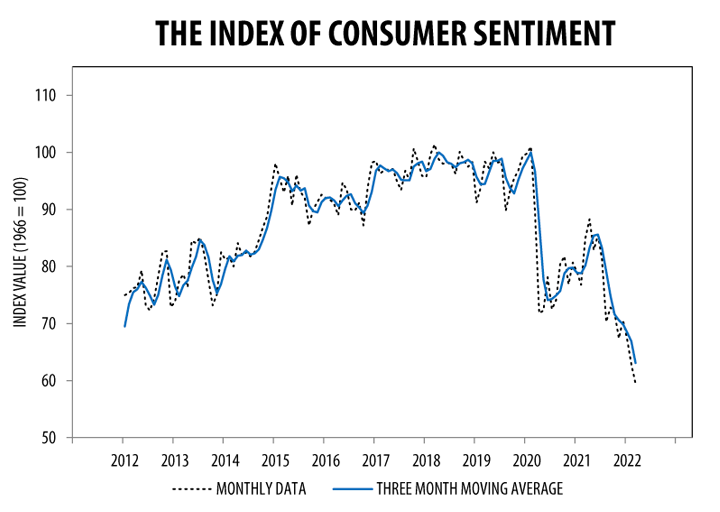

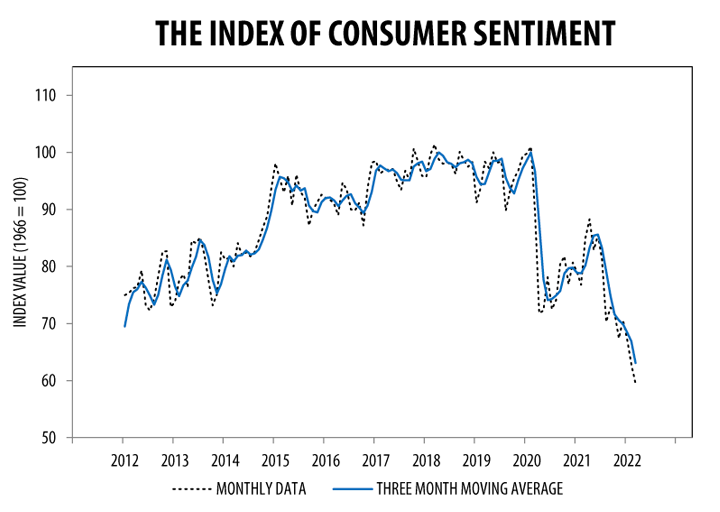

The following chart, showing 10 years of consumer sentiment measures, indicates a similar downward trend as the CCI.

https://collisionweek.com/2022/03/28/consumer-sentiment-declined-march-inflation-concerns/

Similarities and Differences

The investing public generally interprets the results of both CCI and MCSI the same way. If the measure is up compared to last month, consumers should be willing to spend more money. If the measure is down compared to last month, then consumers should be tightening their belts.

However, the results of these two indexes can, and do, diverge in the short term due to a number of factors: Both surveys are conducted monthly but not simultaneously. As an example, a sudden rise in gasoline prices or a drop in the stock market (just as either survey is being conducted) can affect the numbers greatly.

The Conference Board survey queries a larger sample (3,000 versus 500 households), while the Michigan survey has more detailed questions.

Most economists tend to view the MCSI as a better leading indicator of future consumer spending given its greater focus on personal financial situations – in other words, a better measure of pocketbook issues like the price of gasoline. At the same time, many say the CCI tends to be better at picking up on lagging labor indicators related to the job market and job security – in other words, a better measure of financial conditions and real activity that have already turned.

Conclusion

Both MCSI and CCI measures are important factors in assessing consumer attitudes and, potentially, the upcoming trajectory of economic contributions from the U.S. consumer.

Consumer Confidence and Consumer Sentiment are just two examples of the dozens of economic data-points the Investment Committee at WT Wealth Management reviews every month. Understanding the health and direction of the U.S. economy is important as we review our investment models and discuss how we should be positioned in the face of ever-changing economic conditions.

If you would like to learn more about WT Wealth Management's investment approach and philosophy or if you have individual questions about your own portfolio, please do not hesitate to reach out for a discussion. We're always here for you.