Two decades of tax cuts, responses to the 2001, 2008 recessions and the 2020 pandemic, along with bipartisan spending brought the United States, in January, to its $31.4 trillion legal limit on borrowing -- setting the stage for "yet" another debt limit showdown.

(1)

The Budget Deficit, the National Debt, and the Debt Limit

Let's clearly define a few basic terms first.

Budget Deficit: The amount by which Federal expenditures exceed Federal revenue. Deficits are calculated on an annual basis. The opposite of a budget deficit is a budget surplus. As you can imagine, these do occur, but are quite rare.

National Debt: The cumulative total of all years' budget surpluses (rare) and budget deficits (common). This is the total amount of debt instruments that the federal government has issued.

Debt Limit: Often called the Debt Ceiling, is the statutory maximum amount of debt that the Department of the Treasury can issue to the public or to other federal agencies.

(2) The federal government is not permitted to issue any debt beyond this statutory limit, which can lead to legislative stalemate.

Just the Facts

The federal government's total public debt stood at just under $31.46 trillion as of Feb. 10, according to the Treasury Department's latest daily reckoning. Nearly all of that debt – about $31.38 trillion – is subject to the statutory debt limit, leaving just $25 million in unused borrowing capacity.

(3)

America's debt is now six times what it was at the start of the 21st century, increasing by $25 trillion during that timeframe. The Congressional Budget Office projects that the national debt will grow an average of $1.3 trillion a year for the next decade.

(4)

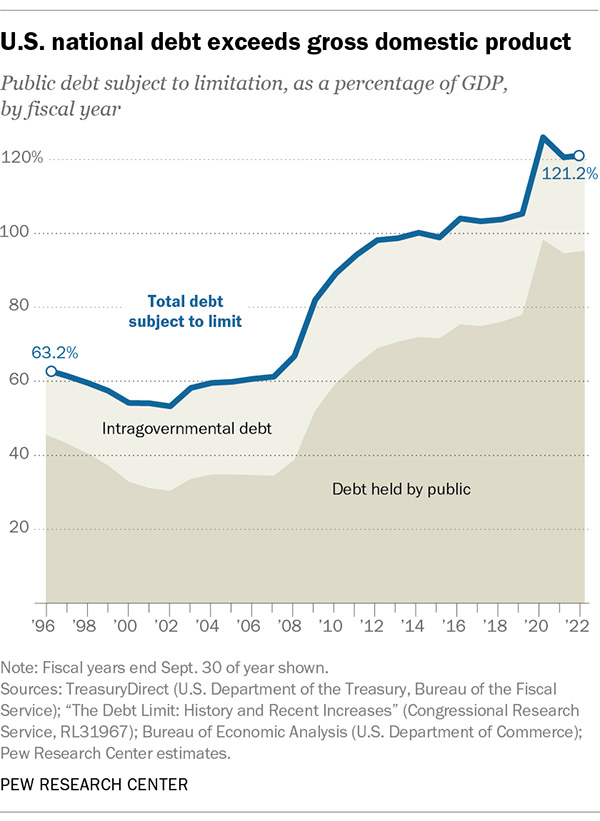

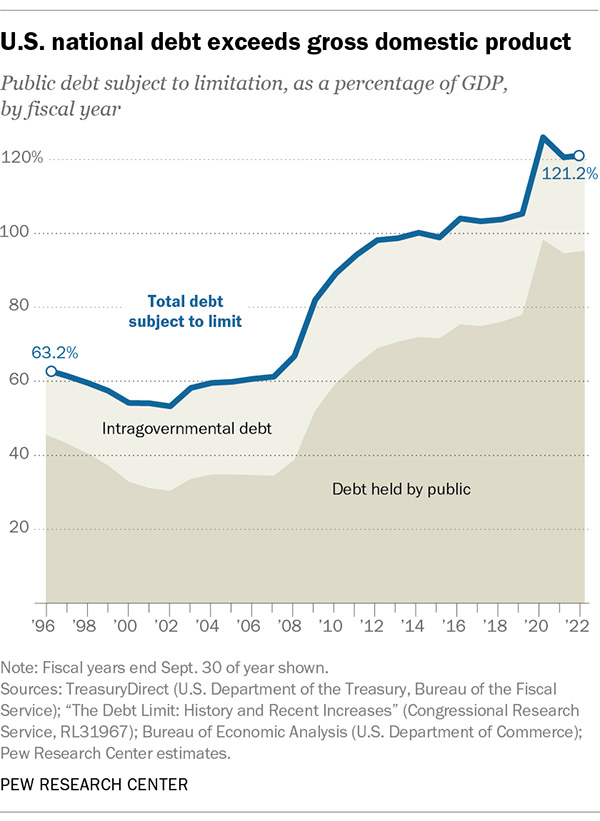

For several years, the national debt has been bigger than its gross domestic product. Debt-to-GDP is a useful metric for analyzing the debt over long time spans, as it puts the debt into relative terms by comparing it against the size of the United States economy.

https://www.pewresearch.org/fact-tank/2023/02/14/facts-about-the-us-national-debt

Servicing the debt is one of the federal government's biggest expenses. Net interest payments on the debt are estimated to total $395.5 billion this fiscal year, or 6.8% of all federal outlays, according to the Office of Management and Budget. That's $100 billion more than the government expects to spend on veterans' benefits and services and more than it will spend on elementary and secondary education, disaster relief, agriculture, science and space programs, foreign aid, and natural resources and environmental protection combined.

(3)

Generally falling interest rates have helped hold down payments even as the dollar amount continues to grow. In fiscal 2021, the average interest rate on federal debt was a record-low 1.605%. But with the Fed raising its policy rate to try to cool off the economy and curb inflation, the U.S. is starting to pay more to borrow (2.07% average in 2022).

(3) This average interest rate is nearly certain to continue rising as interest rates remain elevated.

Who Are Our Creditors?

While U.S. government debt is perhaps the most widely held class of security in the world, 21.8% of the public debt, or $6.87 trillion, is owned by another arm of the federal government itself. That includes Medicare; specialized trust funds, such as those for highways and bank deposit insurance; and civil service and military retirement programs.

(3)

Today, the Federal Reserve System is the single largest holder of U.S. government debt. While the Fed regularly buys and sells Treasury securities to execute monetary policy, it bought Treasuries in massive quantities during the COVID-19 pandemic in an effort to keep the U.S. economy from buckling under the strain of shutdowns and quarantines.

Who's to Blame?

Republicans are refusing to raise the debt limit unless President Biden agrees to steep spending cuts – a stalemate tactic that has played out many times previously on both sides of the political aisle.

America's ballooning debt is the result of choices made by both Republicans & Democrats. Since 2000, both parties have made a habit of borrowing money to finance wars, deliver tax cuts, expand federal spending, care for baby boomers and deliver emergency measures to help the country endure deep economic recessions and a worldwide pandemic.

Looking at the last four Presidents, debt grew by $15.8 trillion when President's Bush & Trump were in office and by $12.2 trillion under President's Obama and Biden, so blame is universal.

(5)

| President |

Year |

Debt At Start ($) |

Debt When Leaving Office ($) |

Debt Change Percentage |

Total Debt Change ($) |

| Joe Biden |

2021-present |

$28,428,918,570,049 |

$30,928,911,613,307 |

8.79% |

$2,499,993,043,258 |

| Donald J. Trump |

2017-2021 |

$20,244,900,016,054 |

$28,428,918,570,049 |

40.43% |

$8,184,018,553,995 |

| Barack Obama |

2009-2017 |

$11,909,829,003,512 |

$20,244,900,016,054 |

69.98% |

$8,335,071,012,542 |

| George W. Bush |

2001-2009 |

$5,807,463,412,200 |

$11,909,829,003,512 |

105.08% |

$6,102,365,591,312 |

| William J. Clinton |

1993-2001 |

$4,411,488,883,139 |

$5,807,463,412,200 |

31.64% |

$1,395,974,529,061 |

| George H. W. Bush |

1989-1993 |

$2,857,430,960,187 |

$4,411,488,883,139 |

54.39% |

$1,554,057,922,952 |

| Democrats |

$12,231,038,584,861 |

| Republicans |

$15,840,442,068,259 |

| Total since 1989 |

$28,071,480,653,119 |

In other words, this is neither a purely Republican nor a purely Democratic problem. Despite all the rhetoric, lawmakers have taken few steps to reduce the federal budget deficit they have produced. In fact, it has been nearly 25 years since the last time the Federal government spent less than it received in taxes – whether under Republican or Democratic control.

(6)

And So ? ? ?

We have seen this play before.

There will be rhetoric, in-fighting and anxious moments. The markets will get jittery as we get closer to a government shutdown and then there will be a solution that both sides will take credit for. Ultimately the debt ceiling will get raised, spending will continue, we'll kick the can down the road, and your investments will continue on as they have in the past.

If you would like to discuss more, we encourage you, as we always do, to reach out to your advisor. We're happy to spend our time answering your questions.

Sources

- How the U.S. Government Amassed $31 Trillion in Debt

The New York Times

- Federal Debt and the Statutory Limit, February 2023

Congressional Budget Office

- 5 facts about the U.S. national debt

Pew Research Center

- The Budget and Economic Outlook: 2020 to 2030

Congressional Budget Office

- U.S. Debt By President

Self Lender

- It's the Revenue Shortfall, Stupid

ITEP