Americans have a serious love affair with cars, and our passion for cars is no secret. Cars have a particular romanticism in America celebrated in songs like "Mercury Blues" written in 1948 referencing the Ford Brand car model and popularized by Alan Jackson's remake in 1993; movies like the 1968 film "Bullitt" featuring what is known as one of the best all-time car chase scenes set in the hilly urban streets of San Francisco; and music videos like "I Can't Drive 55", the 1984 glam-metal hit by Sammy Hagar relating every American's frustration of driving in commuter traffic; and countless other aspects of American culture.

While cars come in every make and model, they have traditionally had one thing in common -- gasoline fed internal combustion engines. Therefore, it may not come as a surprise that the conversion to Electric Vehicles ("EVs"), that many describe as more computer than car, will not be universally embraced by Americans overnight.

Proponents of EVs argue that, with no tailpipe emissions, electric motors are far cleaner than gas engines, while skeptics call out the environmental cost of battery production and electricity generation required to support widespread adoption of EVs. So who is right? Sadly, there is little consensus. The answer depends on your source of information, which, like many hot-button issues in the U.S., have partisan influences and can lead to completely different conclusions when examining the available information on the mining, waste and environmental impact of EVs.

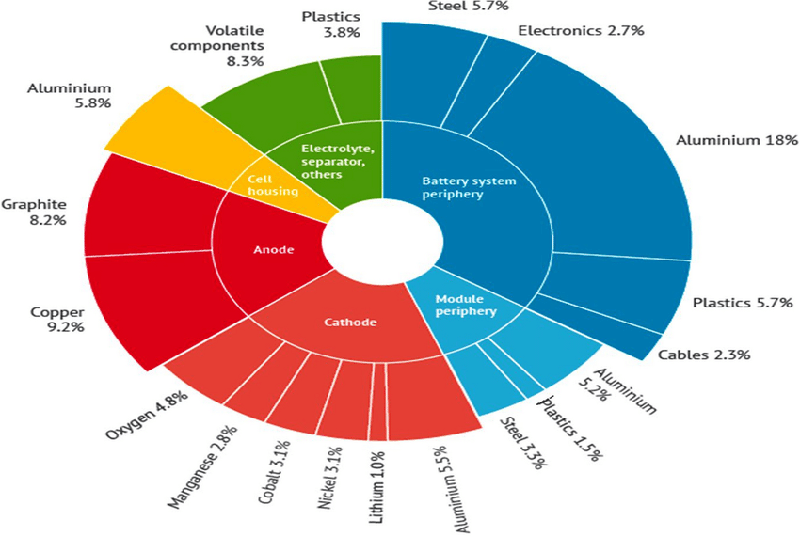

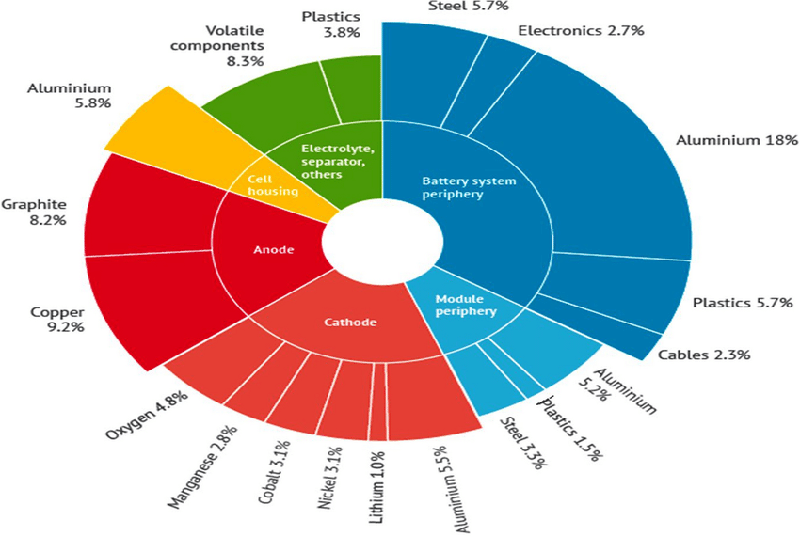

All cars require steel, aluminum, copper, plastic, rubber, and glass. Where EVs differ most from conventional vehicles is in their battery packs. Beneath the floor of the average EV sits a 900-pound battery filled with minerals extracted from around the world. Millions of tons of minerals are mined, processed, and refined -- sometimes leaving a trail of human rights and environmental abuses. For some, that makes fossil fuel engines a better option. No one wants to drive around on the cobalt equivalent of blood diamonds.

A typical 200-mile range EV lugs around a lithium-ion battery pack that is nearly a third of the weight of the vehicle. Much of that weight is the battery pack's casing, structural materials, and a liquid electrolyte that ferries electrons around to charge and discharge the battery. Roughly 350 pounds are crucial minerals or metals, including cobalt, nickel, manganese, graphite, aluminum, and copper. Not counting steel and aluminum, an EV requires six times more minerals than a conventional vehicle.

(1)

Figure 1 -- Generic Composition of a Lithium-Ion Battery Pack

Mining minerals is never a clean affair. Mining cobalt from Congo, lithium and graphite from China, and nickel from Indonesia and Russia are not particularly "green" initiatives. Then there are battery supply chains that run through Xinjiang, in the Uyghur region in China, where forced labor has been rampant. In Guinea, home to the world's largest bauxite reserves for aluminum, mining has caused a near environmental disaster for local communities. Mineworkers in South Africa, the world's largest producer of manganese, face a litany of health issues.

(2)

These environmental and social problems are real. Compared to the track record of the oil, gas and coal industry, proponents of EV say they are a mere drop in the barrel. I'm old enough to remember the Exxon Valdez accident in 1989 and more recently the Deepwater Horizon oil-rig explosion in the Gulf of Mexico in 2010.

To compare EVs with conventional vehicles, we need to look at how much material is pulled out of the ground to make and fuel them. Mining minerals for the clean-energy economy is measured in millions of tons per year. For fossil fuel extraction, that amount could be considered a rounding error.

In 2020, the International Energy Agency estimated global construction on wind turbines, solar panels, EVs and other clean-energy infrastructure demanded 100 million tons of minerals with roughly half for batteries and EVs. The oil, gas and coal industry, by contrast, extracted the equivalent of 15 billion metric tons in 2019 and will need to continue extraction year after year to keep supplying energy. In theory, clean-energy technology can use these materials for decades or, if recycled, in perpetuity. Hence the term renewable energy.

(3)

According to EV advocates, cleaning up the mineral supply chain for batteries, unlike the oil industry, remains a possibility as technology evolves. Mining companies are being pushed, or forced, to clean up their operations as buyers, automakers and countries demand more transparent supply chains. Of course, none of this is guaranteed.

Lead the Charge, an advocacy network tracking the supply chains of the world's leading automakers, says many are making progress on their efforts to eliminate emissions, environmental harms and human rights violations. "But as an industry," it says,

"there is a long way to go." (4)

Researchers and battery makers are accelerating efforts to replace nickel and cobalt with metals like manganese and iron that are safer, abundant, nontoxic, and less expensive. Manufacturers now use six times less cobalt in EV batteries or have eliminated it entirely in recent years. Last year, half of the vehicles Tesla sold in the first quarter contained batteries with no cobalt or nickel.

(5)

So far, the U.S. has a poor track record of recycling lithium-ion batteries. Some estimates show as little as 5% of those batteries end up recycled, most ending up in the trash, stored indefinitely, or exported as waste. Recycling these batteries is still a complex and costly process. The collection and transportation of spent batteries make up nearly half of the cost of recycling. It is anticipated that future technological developments in battery recycling could allow the vast majority of EV batteries to be economically collected and repurposed for a second life, cutting the EV demand for minerals by about a third. But we are not there yet. Lead-acid car batteries provide a model with an estimated 99% being recycled.

(6)

There are many factors influencing consumer behavior besides the social and environmental impact, which we didn't outline here, including the cost of EVs vs. internal combustion vehicles or the current charging vs. gas station infrastructure. There remains numerous questions and challenges to EV adoption including access for rural areas, charging in subzero temperatures, and best practices for extinguishing EV fires and mitigating the toxic fumes they release.

Based on the industry's current trajectory, we anticipate more EVs and less gas-powered vehicles over the next several decades. Is this good or bad? Only time will tell. From the investment perspective, the push to EV may unlock some interesting thematic investing opportunities in the years ahead as technology, efficiency and economies of scale materialize and consumers embrace and adopt EVs. Ultimately, we believe the consumer will dictate the popularity of EVs, not manufacturers or governments.

At WT Wealth Management, we believe our Clients should be informed and able to align their beliefs, interests and values with their investments. For more information, please reach out to your financial advisor. We love to hear from you!

Sources

- WaPo SHOCKER: Clean Energy Is Clean, Actually! (Yes, Including EVs)

wonkette.com

- Are electric cars Really better for the environment

washingtonpost.com

- Global EV Outlook 2020

iea.org

- It's time to lead the charge toward truly clean and equitable cars

leadthecharge.org

- Almost half of Tesla EVs produced in Q1 had no nickel, cobalt in battery

spglobal.com

- The end of a battery's life matters as much as its beginning

vox.com