Being a successful investor is hard. Regardless of how the market is performing, investors are constantly bombarded with warnings of bubbles, bear markets and impending doom. In the financial media, some businesses are even incentivized to use such tactics to grab your attention by capitalizing on known investor fears and loss-aversion tendencies. This excessive noise can lead to short-term actions that are often counterproductive to your long-term objectives.

(1)

If history and our research are any guide, staying the course is a better solution than trying to time markets.

The rewards of staying invested

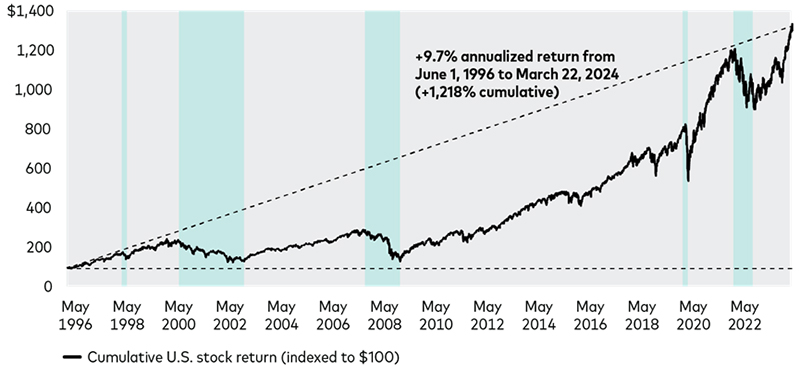

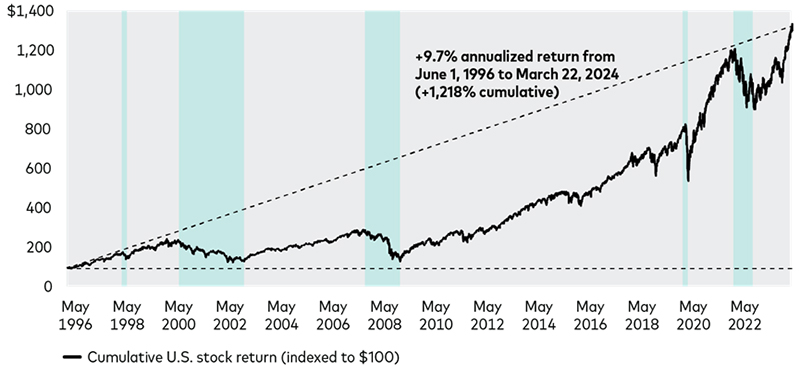

Despite bear markets, corrections and pullbacks, U.S. equities have proved to be a solid investment throughout history, delivering strong long-term returns. Figure 1 shows that since June 1996 equities have returned +9.7% annualized, amounting to a +1,218% cumulative return!

Figure 1: The benefits of staying invested compound over time

Annualized return of U.S. stocks through bull and bear markets

While this period captures one of the most impressive bull markets in history, it also includes the bursting of the Tech Bubble (2000-02), the attack on September 11th, 2001, a global financial crisis (2008-09), a global pandemic (2020), two contested elections, five Presidents and five bear markets.

Can you time the market?

Very few investors are successful at repeatedly timing the market. Sure, someone may get lucky once or twice but even a broken clock is correct twice per day.

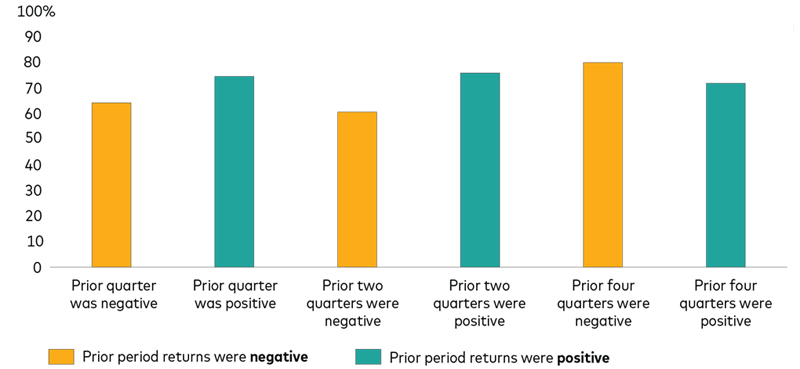

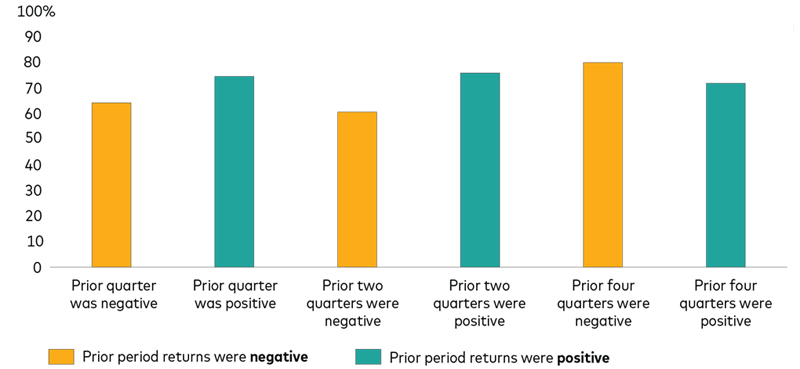

Figure 2 illustrates, regardless of whether the past one, two, or four quarters have been positive or negative, between 60% and 80% of the time, the next one, two, or four quarters had positive results. Said differently, recent performance, good or bad, has little to no bearing on future outcomes. As you can see, more often than not, the markets move higher, which would result in lost opportunity to those who retreated to the sidelines.

Figure 2: Do not let headlines and short-term performance scare you out of the market.

Probability that stocks had positive performance over the next one, two, and four quarters given negative or positive returns over the prior one-, two-, and four-quarter periods.

Know the power of having a plan and sticking to it.

A financial plan that is aligned with your time horizon, investment goals, and risk tolerance has long been proven to be a successful investment approach. Sure, it sounds boring and "too easy" to really work; however, as most investors have probably experienced, it is easier said than done when you are in the midst of an extreme bull or bear market. There will always be temptation to cash out when market prospects appear dire or double down when the markets appear unstoppable. As we are learning, those instincts are seldom in the investor’s best interest.

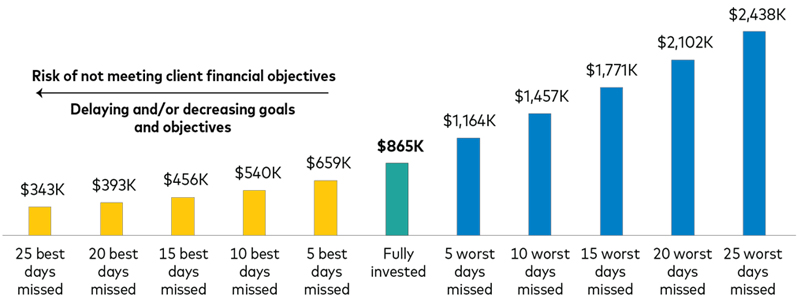

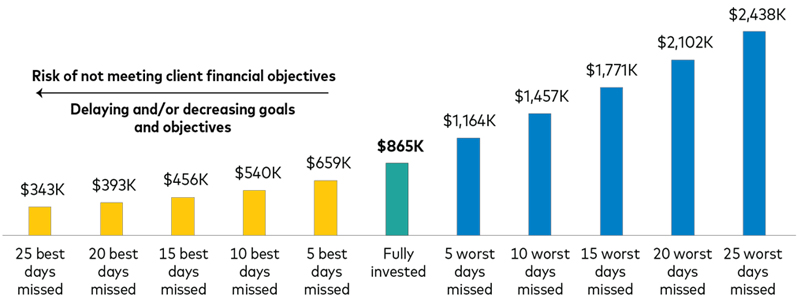

Figure 3 shows that a client with an initial $100,000 investment in a 60/40 (stock/bond) portfolio on June 1, 1996 would have seen their balance grow to $865,000 (as of March 22, 2024)—assuming no additional cash flows, fees, or taxes. Not many investors would turn down 8.6x growth over a roughly 28-year period!

As shown below, a 60/40 portfolio that missed the 25 best days in the market would have lowered ending wealth by approximately $520,000—a shortfall of 60% relative to what could have been achieved by staying invested.

Figure 3: Strategic asset allocation has historically worked, if you stayed invested

Differences in ending wealth given $100,000 investment in a balanced 60/40 portfolio if missing the best (worst) days of performance relative to staying invested for the full period.

The astute reader may be asking why this analysis focuses on the "cost" of missing the best days, but not the benefit of missing the worst days? Indeed, according to Figure 3, the portfolio that misses the 25 worst days outperforms the fully invested portfolio by nearly 3x, bringing the initial $100k investment to over a 24x return during the period. This implies that the investor correctly cashed out on the worst down days and remained invested every other day. To put this in perspective, there were approximately 7,000 market days during this time period. The probability that someone correctly selects even the five worst days is one in ~17 quintillion (17 followed by 18 zeros).

(2) We won’t say it is impossible, but we will say it is extremely improbable (you are 57 billion times more likely to win the Powerball Jackpot).

(3) Of course, this logic can equally be applied to both sides of the analysis. But, regardless, the conclusion is the same - increase your chance of success by staying invested!

Make blocking out the noise your investing mantra.

There’s always uncertainty in markets, and fear is a powerful force that is challenging to overcome. At WT Wealth Management we firmly believe in blocking out the noise, staying invested and focusing on your individualized plan. We aid our clients in better understanding these important investing principles through education, like this White Paper.

We periodically write these "investing basics" White Papers every 12-18 months to remind our Clients that have been around a while, and educate those that have not, that investing can be rewarding if you don’t talk yourself out the markets over something that may happen tomorrow.

History has shown repeatedly that staying invested and not trying to time markets increases your chances of financial success. As always, if you would like to discuss this, your plan, or other topics more closely, please contact your financial advisor.

Sources

- The difficulty and rewards of staying the course

vanguard.com

- Assuming you have an equal chance of picking one of the worst days on any given day in the period.

- Your chances of winning Powerball are still only 1 in 252.2 million, so don’t go selling your retirement portfolio to buy Powerball tickets just yet!