Three months ago, we delivered a white paper entitled, "

When is Good News Bad & Bad News Good?" We recently saw the real life answer to that question as January economic data was released.

The Federal Reserve is trying to slow consumption of goods and services, decrease spending and orchestrate tighter economic conditions in its battle against inflation. However, the job market and the US consumer seem to have their own ideas about what living their "best life" means.

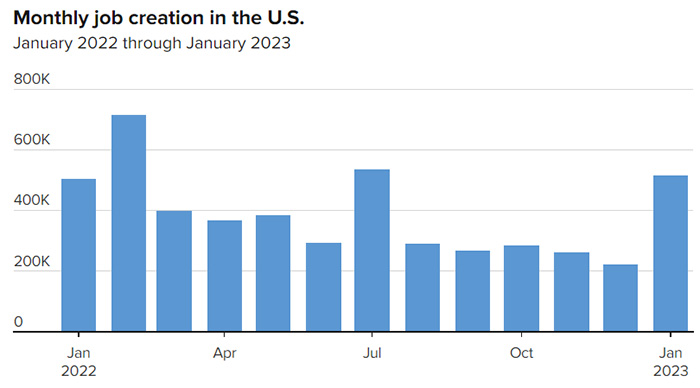

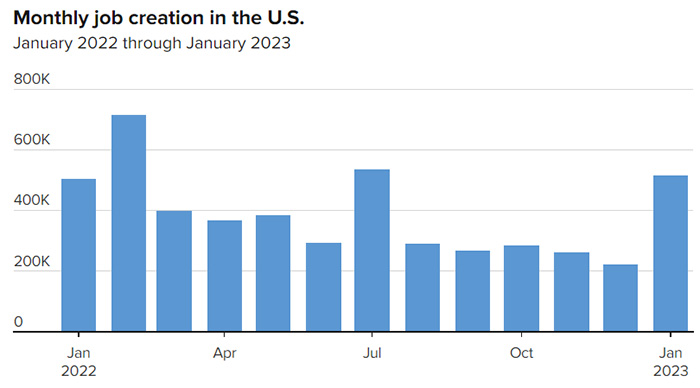

Jobs & Employment

On February 3rd the January jobs report showed that the US economy added 517,000 new jobs (compared to forecasts of 187,000 new jobs) and unemployment hit a 53 year low at 3.4%. Leisure & hospitality added 128,000 jobs alone to lead all sectors. Other significant gainers were professional & business services (82,000), government (74,000) and health care (58,000). Wages also posted solid gains for the month, with average hourly earnings increasing 4.4% year over year.

(1)

https://www.cnbc.com/2023/02/03/jobs-report-january-2023-.html

Consumer Spending

Then on February 15th, the January retail sales report showed America's consumers rebounding from a weak holiday shopping season in November and December, boosting spending at stores & restaurants by 3.0% year over year, the fastest pace since March 2021. Excluding the pandemic era, January's rise was the largest in more than two decades.

Driving gains were a jump in auto sales, along with robust spending at restaurants, electronics & furniture stores. Some of the supply shortages that had slowed auto production have eased, and more cars are gradually moving onto dealer lots. The enlarged inventories have enabled dealers to meet more of the nation's pent-up demand for vehicles.

(2)

The PBS News Hour stated, "Whether America's shoppers can continue to spend briskly will help determine how the economy fares... For all the challenges facing consumers, they continue to show resilience."

(3)

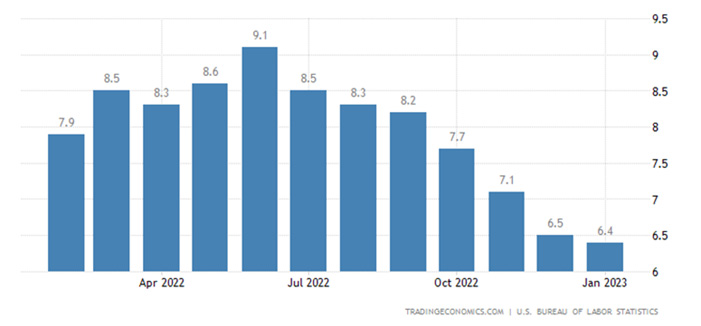

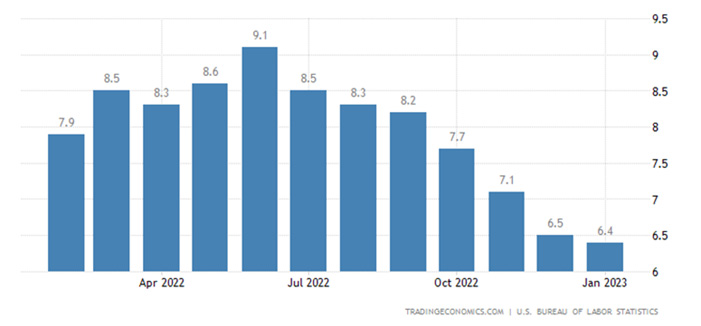

Inflation

On February 14th, the Consumer Price Index (CPI) for January revealed a 0.5% month over month increase. Year over year, CPI rose 6.4%. While still on a downward trend, it is slowing as economists had expected to see 6.2%.

(4)

Year over Year CPI

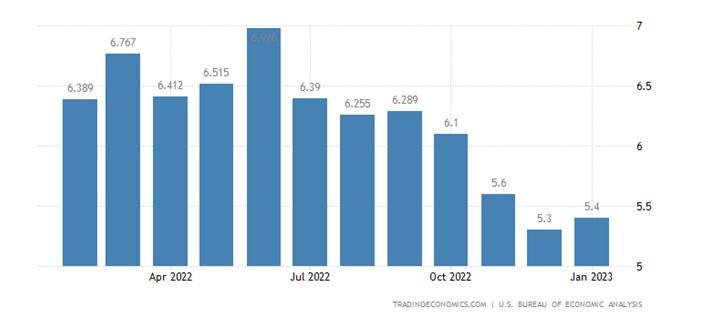

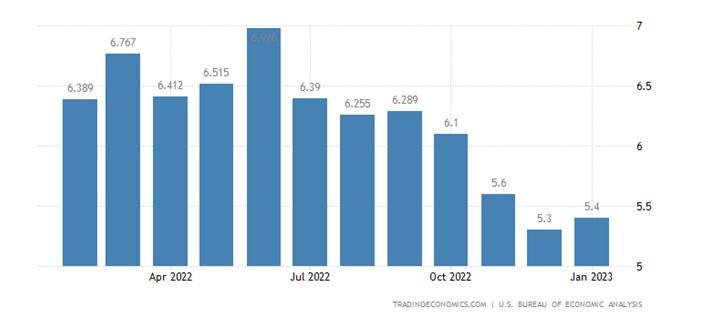

Lastly, on February 24th, the Fed's preferred inflation gauge, the Personal Consumption Expenditures price index (PCE), jumped 0.6% in January — the biggest increase since last summer — in another sign that stubbornly high inflation is likely to take a while to return to the targeted 2.0% pre-pandemic levels.

Like CPI, the PCE index has tapered off since the peak last summer. However, January's year over year figure showed the first uptick in seven months, moving from 5.3% in December to 5.4% in January.

(5)

Year over Year PCE

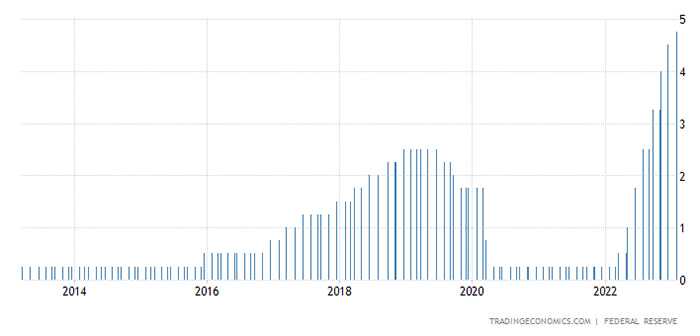

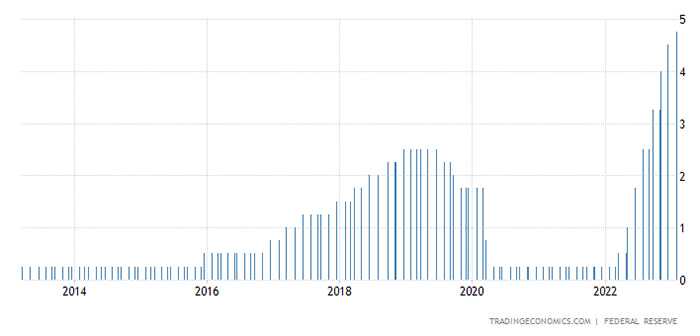

The Federal Funds Rate

As we have stated many times, economic strength is not free. The combination of solid spending and robust hiring, combined with persistent inflation, will likely increase pressure on the Federal Reserve to continue raising its benchmark Fed Funds Rate even further than it already has. The Fed has already signaled that it expects to carry out two more quarter-point hikes, to a range of 5.00% to 5.25%. That would be the highest level in 15 years, but even that may not be enough.

10-Year History of the Fed Funds Rate

https://tradingeconomics.com/united-states/interest-rate

It's so counter-intuitive to hope for weaker economic data and higher unemployment numbers, but that is exactly what the Fed has been targeting in its battle against inflation. The data shows they may need to get tougher for longer.

How Do We Respond?

Based on our constant review of economic data and Federal Reserve minutes, the Investment Committee at WT Wealth management has recently recalibrated our expectations over how quickly inflation is falling and how high the Federal Reserve will raise rates in order to stabilize prices. Last week, Fed Funds Futures which measures market expectations for the federal funds rate, showed the range with the highest probability at the end of the year was 5.00% - 5.25%, or two more increases of 0.25% each before a pause in Fed tightening. At WT Wealth Management, in light of the recent CPI and PCE readings, we think the terminal Fed funds rate will end up closer to 6.00% than 5.00%. In other words, our Investment Committee feels the Fed Fund Futures are 1 or 2 rate increases short of where rates likely will end up in reality.

While this may not be the best news for equities in the short-term, it could be good news for fixed income investors over the next 12-18 months.

Granted, inflation is down substantially from the peak, but we feel continued straight-line moderation is not a forgone conclusion, especially in light of strong consumer spending, persistent wage gains and continued strength in the labor markets. The most recent inflation readings, slowing or even slightly reversing course, clearly show that. This fight will be harder than market participants are currently projecting.

All of these observations lead us to believe the Fed will not move to ease conditions in 2023, as many market participants are hoping for. We anticipate a highly restrictive monetary policy will remain in place until at least early 2024. The Fed has been steadfast in the rhetoric and communication that not winning the inflation war is not an acceptable alternative. We believe Chairman Powell really means this. Other market participants are beginning to show that they believe him too.

We currently maintain our optimistic, but cautious, outlook on the equity markets. The strong economic data we are seeing could be evidence of the cushion the Fed needs to generate the soft-landing recession we all hope for.

Your advisor is prepared to discuss all of this economic data and Investment Committee perspective in detail with you. Please reach out if you would like to learn more.

Sources

- Jobs report shows increase of 517,000 in January, crushing estimates, as unemployment rate hit 53-year low

CNBC.com

- Retail sales jump as Americans defy inflation and rate hikes

Finance.Yahoo.com

- American consumers retail sales jump as Americans defy inflation and rate hikes

PBS.org

- Inflation rises 0.5% over last month in January, most since October

Finance.Yahoo.com

- Inflation jumps again, PCE shows, and stays stubbornly high at over 5%

MarketWatch.com