August's market weakness on recession fears may have caused a minor panic attack in many investors. As we talk to our clients, nearly every investor remembers 2018 when the markets provided three quarters of exceptional returns... then gave it all back and more in the last quarter.

In the later part of August, long-term bond yields (10 year vs 2 year) dipped below the yield on short-term bonds. This "yield curve inversion" phenomenon has historically preceded every U.S. recession. However it is important to recognize that yield curve inversion is not the 100% indicator of recession that the press would lead you to believe. There have been yield curve inversions that did not precede a recession. See our

April 2019 White Paper for more info.

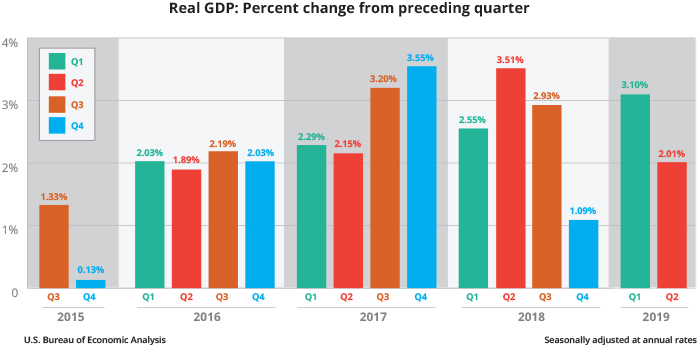

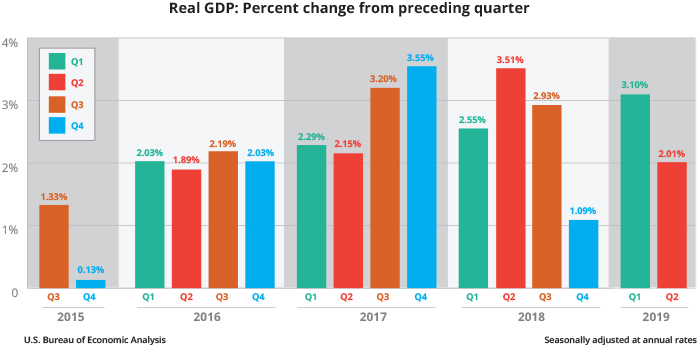

Many economic data-points remain strong: Unemployment is low, job creation is high and consumer sentiment remains healthy. GDP has remained positive, albeit slowing (remember, a recession is defined as two successive quarters of negative GDP). With Q2 GDP at +2.1%, it would take considerable economic weakness for the U.S. to recede into negative GDP territory, namely, a sharp rise in unemployment and a retreat in consumer spending.

(1)

Economic cycles come and go like the tide. We are clearly in the late stages of this economic expansion, which began in 2010. There's not a single economist that would argue with the "late stage" description of today's economy. The real discussion is whether we are in the 7th, 8th or 9th inning (keeping in mind that there's nothing to prevent a 10th, 11th or 12th inning either).

Markets are incredibly complex but have rewarded investors that ignore the noise and stay focused on the long-term results. As Warren Buffett famously said, "the stock market is a device for transferring money from the impatient to the patient."

What investors can do is absorb the lessons learned from the last recession and prepare themselves for more difficult financial times. Sadly, the lessons of 2008-2009 generally fall on deaf ears.

Americans owe an astounding $1.03 trillion

(2) in credit card debt, according to the Federal Reserve. That amount is virtually the same credit card debt levels we had in 2007 - pre-financial crisis. Housing prices seemingly are climbing nearly every quarter, which usually means larger mortgages. However, mortgage rates today are incredibly low compared to 2007 when a 30 year mortgage in March 2007 averaged 6.14%. A year earlier, in March of 2006, it was 6.37%. Underwriting and loan approval is substantially more difficult today compared to a decade ago and many feel today's homeowner is in a better financial place to actually afford that home.

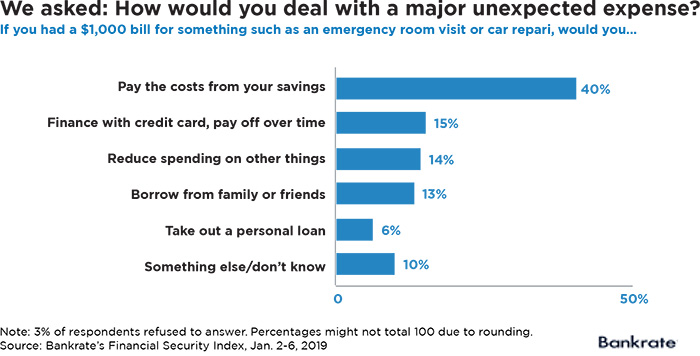

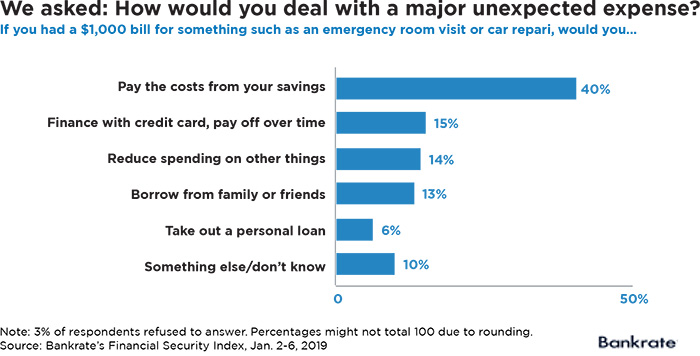

However, Four in ten Americans can't come up with the immediate funds to cover an unexpected $1,000 expense, according to a new report from the Federal Reserve Board. Those who don't have the cash on hand say they'd have to cover it by borrowing or cutting back elsewhere.

(3)

As we sit with prospective clients, we encourage each investor to save four to six months' worth of living expenses before putting capital at risk in the financial markets. We also encourage prospective clients to eliminate all revolving high interest debt before investing. Why pay a credit card company 15-22% interest when the long-term average of the equity markets is less than 10%?

The "good times" are when households should prepare for the future — building emergency funds, paying off liabilities and creating disciplined, realistic budgets. The irony of good economic times is that they encourage consumers to spend more and save less — the opposite of sound financial behavior.

We encourage you to ask yourself some basic questions:

- Do you have enough money set aside to cover a $1,000 emergency expense?

- Have you set aside four to six months' worth of living expenses?

- Are you using excess income to pay off debts or to buy new things?

- Are you spending less than you earn?

- Where are the opportunities to cut expenses?

- Do you belong to a gym you have not seen in three months?

- How much does the family spend eating out each month? What's your monthly Starbucks damage?

- Do you shop for needless things at Amazon or eBay just because the app is on your phone?

- Can you get a better, cheaper family mobile-phone plan just by shopping around?

Just like every successful business, each household should do a cash flow report twice per year to understand where their money is going. These all may seem like little things. But by being fiscally aware you may be able to increase your savings, fund a Roth IRA or even a 529 plan for your children or grandchildren.

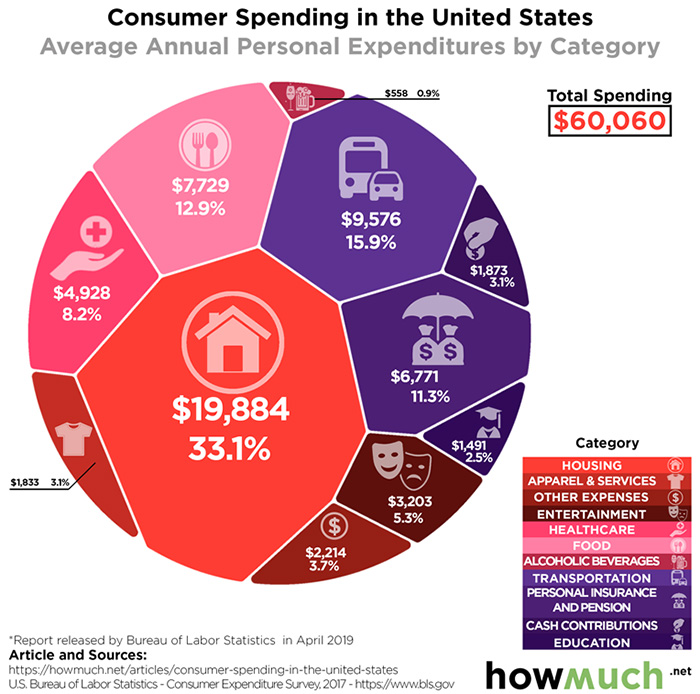

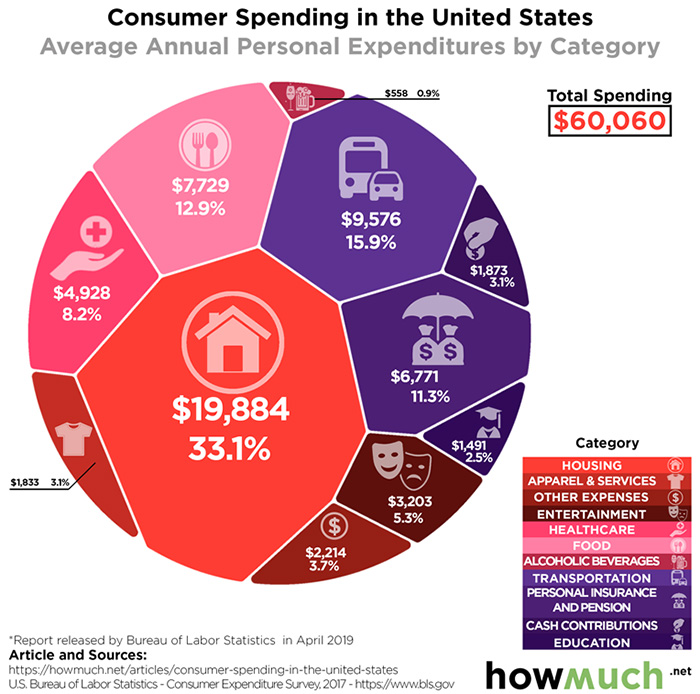

In April 2019, the Bureau of Labor Statistics (BLS) released the latest Consumer Expenditure Survey report to analyze broader economic trends related to consumer spending. Data from this report paints a picture of how the average American household allocates its budget.

(4)

Here are a few takeaways from the BLS report. Average household income, after taxes, was $63,606. So after all other expenditures were accounted for, that left just $3,546 to be allocated toward savings. However, these numbers represent the U.S. average and averages never tell the whole story. Consumer spending varies significantly from household to household, based on factors such as income, location, cost of living, household debt, and whether someone is a homeowner or a renter.

According to the BLS report data, the average consumer in the bottom 60% of earners spent more than they earned. Similarly, the average consumer under the age of 25 and the average consumer over the age of 65 had expenditures greater than their income.

WT Wealth Management is an SEC registered investment adviser, with in excess of $100 million in assets under management

(AUM) with offices in Flagstaff, Scottsdale, Sedona and Tucson, AZ along with Jackson Hole, WY and Las Vegas, NV.

WT Wealth Management is a manager of Separately Managed Accounts (SMAs). With SMAs, performance can vary widely

from investor to investor as each portfolio is individually constructed and managed. Asset allocation weightings are

determined based on a wide array of economic and market conditions the day the funds are invested. In an SMA, each

investor may own individual Exchange Traded Funds (ETFs), individual equities or mutual funds. As the manager we have

the freedom and flexibility to tailor the portfolio to address an individual investor's personal risk tolerance and investment

objectives - thus making the account "separate" and distinct from all others we manage.

An investment with WT Wealth Management is not insured or guaranteed by the Federal Deposit Insurance Corporation

(FDIC) or any other government agency.

Any opinions expressed are the opinions of WT Wealth Management and its associates only. Information offered is neither

an offer to buy or sell securities nor should it be interpreted as personal financial advice. Always seek out the advice of

a qualified investment professional before deciding to invest. Investing in stocks, bonds, mutual funds and ETFs carries

certain specific risks and part or all of an account's value can be lost.

In addition to the normal risks associated with investing, narrowly focused investments, investments in smaller companies,

sector and/or thematic ETFs and investments in single countries typically exhibit higher volatility. International, Emerging

Market and Frontier Market ETFs, mutual funds and individual securities may involve risk of capital loss from unfavorable

fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political

instability that other nations experience. Individual bonds, bond mutual funds and bond ETFs will typically decrease in

value as interest rates rise. A portion of a municipal bond fund's income may be subject to federal or state income taxes or

the alternative minimum tax. Capital gains (short and long-term), if any, are subject to capital gains tax.

Diversification and asset allocation may not protect against market risk or investment losses. At WT Wealth Management, we

strongly suggest having a personal financial plan in place before making any investment decisions including understanding

personal risk tolerance, having clearly outlined investment objectives and a clearly defined investment time horizon.

WT Wealth Management may only transact business in those states in which it is registered, or qualifies for an exemption

or exclusion from registration requirements. Individualized responses to persons that involve either the effecting of

transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without

registration or exemption. WT Wealth Management's website is limited to the dissemination of general information

pertaining to its advisory services, together with access to additional investment-related information, publications, and

links.

Accordingly, the publication of WT Wealth Management's website should not be construed by any consumer and/or

prospective client as WT Wealth Management's solicitation to effect, or attempt to effect transactions in securities, or the

rendering of personalized investment advice for compensation, over the internet. Any subsequent, direct communication

by WT Wealth Management with a prospective client shall be conducted by a representative that is either registered or

qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of WT Wealth Management's current written disclosure statement discussing WT Wealth Management's registrations,

business operations, services, and fees is available at the SEC's investment adviser public information website (www.

adviserinfo.sec.gov) or from WT Wealth Management directly.

WT Wealth Management does not make any representations or warranties as to the accuracy, timeliness, suitability,

completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to WT Wealth

Management's web site or incorporated therein, and takes no responsibility therefor. All such information is provided solely

for convenience purposes and all users thereof should be guided accordingly.