Our

August 2020 White Paper addressed the first rumblings of possible inflationary pressure as a result of low interest rates and unprecedented amounts of fiscal stimulus. Now seven months later, with a recently passed $1.9

rillion stimulus package and a potential $2 trillion infrastructure package on the way, we would like to revisit the topic of inflation.

Today, it is nearly impossible to read any financial publication where inflation isn’t one of the headline fears. The pandemic-fueled combination of low interest rates, unprecedented stimulus from Washington DC, and the hope of a return to normal following a wide-spread vaccination program across the United States and the world will very likely result in unprecedented consumer consumption – the story of “pent up demand”. We all remember from Economics 101 that as demand increases, prices will rise. That’s another way to say, “inflation”.

Inflation in Practice

Simply put, inflation refers to the rise in price of goods and services. As prices go up, the purchasing power of money decreases. In other words, inflation makes your money worth less over time.

There are two types of inflation:

- Cost-push inflation – when a rise in prices is caused by a rise in the cost of production (e.g., higher oil prices).

- Demand-pull inflation – when a rise in prices is caused by increasing demand, which leads producers to push up prices either due to the shortage of production materials or because the consumer is simply willing to tolerate it.

Rising inflation means the blended cost of goods and services is increasing. For example, if you paid $100 for your basket of items last year and inflation is currently measured at 2%, then those items can be reasonably expected to cost $102 today. This does not mean the prices of all items will increase by 2%—some will rise more, others less, and some may even fall. You probably noticed that health care costs have increased much faster than 2% in recent years, while the cost of an HDTV has fallen.

How is Inflation Measured?

In the U.S., inflation is often measured by the Consumer Price Index (CPI) or the Personal Consumption Expenditures Price Index (PCE). The CPI is calculated by the Bureau of Labor Statics (BLS) and is used by many government agencies to make changes to benefit payments such as social security cost-of-living adjustments. Meanwhile, the PCE is calculated by the Bureau of Economic Analysis (BEA) and is the Federal Reserve’s (Fed) preferred method of calculating inflation.

(1)

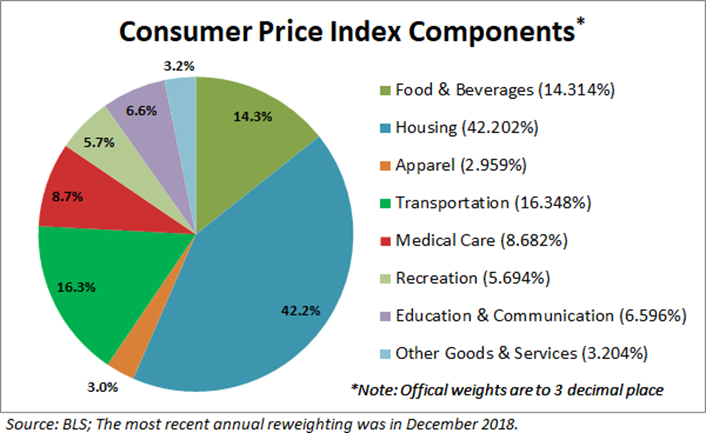

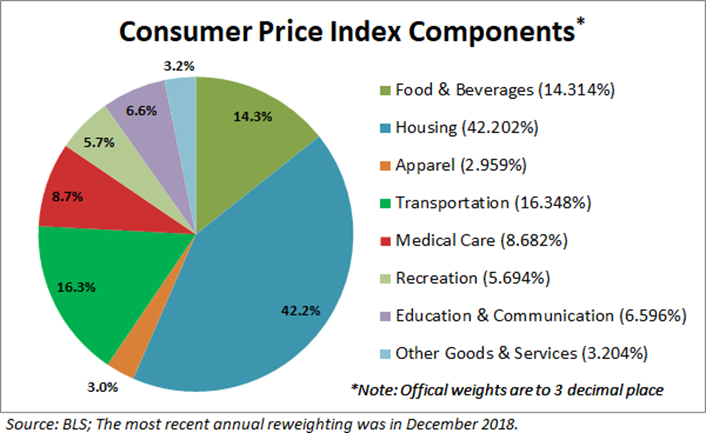

The CPI is calculated through quarterly survey-based interviews of the spending habits from over 24,000 people across the country (each person participates over a two-year period). In order to collect information on frequently used items, such as food, drink, and personal care; data from another 12,000 consumers, who keep a diary listing everything purchased during a two-week period, is included. All of this information is used to determine the importance or weight, of the item categories.

The CPI covers 200 sub-categories, across eight major groups (food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services). Roughly 80,000 items are included within these groups.

Every few years, the BLS will update the basket of goods to account for new consumer trends. For example, radios may be removed and iPhones added (education and communication). In order for the CPI to remain relevant, these changes are necessary, but can skew the inflation rate. Older items such as radios tend to decline in price. Comparatively, newer technology items frequently cost more due to more expensive components and consumer demand . So when new items are added, there is a tendency for the CPI to overstate inflation on an item-by-item basis. However, when viewed on a functional basis (i.e., the consumer demand for communication technology) the CPI remains accurate.

How is Inflation Managed?

Central banks, like the Fed, often try to manage inflation through interest-rate policy. In practice, this means they will adjust benchmark interest rates (i.e., the rate at which major banks borrow and lend with each other, which serves as the basis for most other banking decisions throughout the U.S. economy) higher or lower when inflation is off-target. Higher interest rates mean money is more expensive to borrow, which serves as an impediment to borrowing and spending, thus keeping inflation lower. Conversely, lower interest rates promote borrowing and spending, thus stimulating inflation.

Many economists see inflation as a fair trade off to ensure that the economic recovery can mature and stabilize (and the WT Wealth Management Investment Committee agrees). Then, when the Fed eventually applies the brakes via higher interest rates, the economy will be healthy enough to endure tightening monetary policy. In other words, inflation isn’t fundamentally a good or bad thing. Sometimes rising inflation rates are appropriate. Other times declining inflation rates are preferred. Much depends on the surrounding economic environment.

Inflation Fears Surge. But Are They Overdone?

Economists are optimistic, especially because Uncle Sam is providing such strong support for the economy. Goldman Sachs is now calling for the US economy to register GDP growth of 7% on a full-year basis in 2021 (that’s more typical of China than the US). That would be the fastest pace for the United States since 1984. And Goldman Sachs expects the US economy will be 8% larger at the end of 2021, compared with the end of last year. By that measure, it would be the fastest GDP growth since 1965.

However, optimism — on top of unprecedented stimulus from Congress and the Fed — is making some on Wall Street concerned that the economy could overheat. In fact, for the first time since February 2020, Covid-19 is no longer the number one fear among portfolio managers surveyed by Bank of America. Inflation is now the top risk. The findings underscore how drastically the situation has changed during the past year. Confidence is growing because of the rollout of vaccines, easing health safety restrictions and unprecedented support from the federal government.

(2)

The big fear is that resurgent inflation could cause the Federal Reserve to rapidly raise interest rates, short-circuiting the economic recovery and the market boom. That's what happened in the 1970s and early 1980s when the Paul Volcker-led central bank tamed inflation with aggressive interest rate hikes.

But top US officials have pushed back against inflation fears. Within the last several weeks, Treasury Secretary Janet Yellen said inflation may move higher, but only temporarily. "To get a sustained high inflation like we had in the 1970s, I absolutely don't expect that," Yellen told ABC.

Recently, when questioned about the possibility of inflationary pressures, Fed Chair Jerome Powell said: "We’ve been living in a world of strong disinflationary pressures for the past quarter century. We don't think a one-time surge in spending leading to temporary price increases would disrupt that."

While he acknowledged that "bottlenecks" in the global supply chain could lead to some "upward pressure on prices," he said any inflation would not be sustained and that the Fed would not make any adjustments — such as hiking interest rates — until there is “data-driven” evidence.

(3)

Conclusion

Inflation may be a “necessary evil” in times such as these. With the world fighting for its life against an unseen viral enemy, central banks and lawmakers had no choice but to pump incredible amounts of liquidity into the financial system.

After all, the immediate “virus prevention” protocol was to stay home: do not travel, dine out or gather in public. In many cases the protocol became don’t even go out for work or school. Just isolate at home. All of that could be reversed with widespread vaccine implementation and eventual herd immunity. As people around the globe emerge from seclusion and return to a more regular daily, public life we do believe pent up demand will be a real story. At the same time, we believe many social behaviors that were considered normal in the past may not resume for long periods of time, if ever.

The Investment Committee at WT Wealth Management watches inflation and a vast array of other economic indicators for risks and threats to client portfolios and future purchasing power. But like most economic indicators, inflation is rearward looking. Once the numbers are reported, the impact has already been felt.

But rearward looking indicators can provide clues for moving forward. We do feel inflation will run hotter than we are accustomed to for the next little while. However, we don’t feel it is the looming threat the mainstream media is making it out to be. In the end, the Fed will slowly raise interest rates, demand will moderate, and inflation fears will subside.

As we said at the beginning, inflation diminishes the purchasing power of money over time. Knowing this, investors should always consider the impact of inflation on their portfolios. A well-diversified mix of stocks and bonds may be expected to return 7% annually on average. However, the real expected return would only be 5% based on a 2% inflation estimate.

Please reach out to your advisor at WT Wealth Management if you would like to review the impact of inflation on your portfolio.

SOURCES:

(1)https://seic.com/knowledge-center/investment-fundamentals-what-inflation

(2)https://www.cnn.com/2021/03/16/investing/wall-street-covid-inflation-economy/index.html

(3)https://www.nbcnews.com/business/economy/powell-plays-down-inflation-again-while-yellen-sees-possible-return-n1261824