It's been nine months since we wrote our first cryptocurrency article,

Cryptocurrency: A Brief Overview. If you've read that article, paid attention to the ups and downs of cryptocurrencies, heard about coins, tokens, block chains, smart contracts, and NFTs in the news and pop culture, well then, you're still probably just as confused as we are!

The world is still figuring out what role these innovations will have in our lives. Cryptocurrencies may someday replace fiat currencies, become a diversifying store of value in your portfolio – like gold, remain a purely speculative asset, or all or none of the above. This article isn't meant to convince you why you should invest in crypto, but we will explain how you can get started through an explanation of cryptocurrency trading exchanges and the primary types of crypto wallets.

If you've decided you're ready to get started, there are two decisions you'll face right away. You'll need to figure out how you're going to acquire a cryptocurrency (coin), and where you are going to store it.

Exchanges

A cryptocurrency exchange is a website that allows users to buy and sell coins in exchange for a fiat currency or other cryptocurrencies. Crypto exchanges are like stock or commodities exchanges as they provide a central location with defined rules to facilitate transactions between buyers and sellers. Most exchanges have a built-in web-based or desktop-based wallet to allow users to store their digital assets online for easy access while trading. Trading occurs 24/7 on crypto exchanges and is not limited to traditional market or banking hours. Exchanges are either centralized and managed by a third party or decentralized and not dependent on a third party.

Centralized Exchange

Centralized exchanges offered by Coinbase, Binance, and Gemini are very popular, and feel similar to a stock exchange, such as the New York Stock Exchange. A centralized exchange takes on numerous roles to attract clients and maintain a safe and orderly trading environment. The exchange acts as a custodian, providing a safe place to store assets. They also act as a market maker providing liquidity and ensuring trades execute as quickly as possible. And they offer user friendly features such as customer support, margin trading, portfolio management tools, and many other user-friendly features.

A centralized exchange acts as a gateway between cryptocurrencies and fiat currencies. For example, the exchange facilitates the conversion between U.S. Dollars and Bitcoins, or Ethereum and Euros. Most centralized exchanges also go to great lengths to prevent fraud and hacking and, at least in the U.S., conduct the same level of identity verification that traditional banks or brokerage firms use. Coinbase, for example, is publicly traded and is compliant with government and financial regulations.

Centralized exchanges have brought ease, legitimacy, and liquidity to cryptocurrency trading, but what is in it for them? There are four common ways that centralized exchanges generate revenue. The most obvious is the fee or commission charged per transaction, regardless of the underlying value of the cryptocurrency being traded. Second, the exchange acts as a market maker and keeps the spread between the bid and ask while facilitating trade execution and maintaining liquidity. Third, an exchange can charge listing fees to a newly created cryptocurrency as compensation for offering it on their exchange. Finally, an exchange can act as a pre-IPO marketplace for soon-to-be released coins or tokens and retain a commission or fee once the crypto is publicly available.

Decentralized Exchange

Decentralized crypto exchanges are still a gathering point between buyers and sellers, but there is no third-party acting as the middleman facilitating the trading. Instead, trades are made peer-to-peer, or user-to-user utilizing the blockchain. This is more of a wild west trading environment reminiscent of pink-sheet penny stock trading of the 90's. Since there is no central market maker, these decentralized exchanges tend to have poor liquidity, slower execution, and wider bid/ask spreads. It takes longer for buyers and sellers to be matched together, and prices are slower to react to supply and demand than would be the case on a more liquid centralized exchange.

Since transactions occur directly between users on the blockchain, decentralized exchanges cannot be used as a fiat gateway. Instead, decentralized trades occur using pairs of cryptocurrencies, not dollars. Each exchange calculates the current price of the coins they support based on trading volume as well as supply and demand. The greater the volume, the more accurate the price will be. There is no fixed price for any coin. Prices are always set by the market.

There are several reasons some users seek out decentralized exchanges. One is cost. Since there is no middleman, there are typically no fees or commissions. Another is security. Since transactions are conducted directly on the blockchain they are very secure, anonymous, and fraudsters typically are not a concern. Since prices are decentralized and exchange prices may vary, savvy traders or trading programs can find arbitrage (risk-free profit) opportunities.

Crypto Wallets

A wallet is a broad term for where you can store and send your coins. Like a real-world wallet, there are variations and different features in crypto wallets regarding ease of access and safety. In the real world, using a simple money clip would offer speed and ease at the expense of security. A leather wallet with a chain, padlock, and RFID protection would have an elevated level of security at the expense of speed, ease, and comfort. The money clip version of a crypto wallet would be a hot wallet, while the more secure version would be a cold wallet.

Hot and cold are commonly used terms related to storing and accessing digital data. In the simplest sense, a hot wallet is connected to the internet and a cold wallet is not.

A common trait between hot and cold wallets is the fact they don't actually contain your coin – rather, they contain your public and private keys that give you access to your coin (which is stored either online or on a blockchain). Choosing the right wallet will depend on how often you need access to your coin, the type and frequency of transactions you make, and the amount of protection you desire.

Hot Wallets

Hot wallets are the easiest place for investors to get started. Hot wallets come in three main forms. (1) Web-based wallets you access using the internet, (2) desktop-based wallets installed on your personal computer, and (3) mobile wallets installed on your smartphone or tablet.

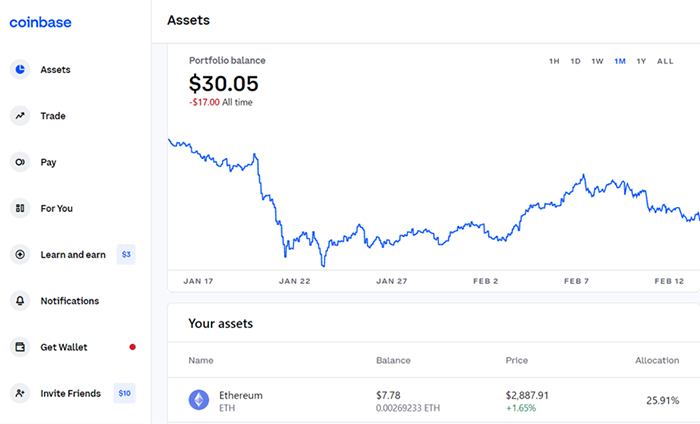

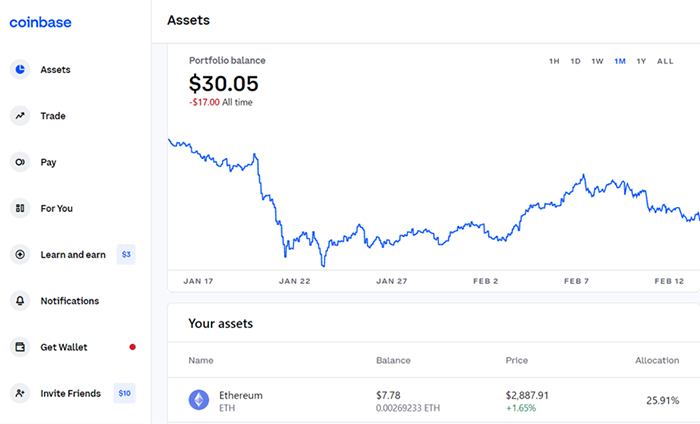

Web-based wallets feel a lot like accessing your bank account online. The most well-known companies, such as Coinbase, eToro, Binance, Gemini, and Kraken, all offer their own version of a web-based wallet. All that is needed to access your web-based wallet is an internet connection and login credentials. Web-based wallets feature the easiest access due to not requiring software to be installed on a device. Login IDs and passwords can be recovered through the provider's customer service team and the interface is typically simple and easy to use. The wallet provider typically acts as the custodian and maintains a record of the assets a user carries in their wallet.

Coinbase web-based wallet interface

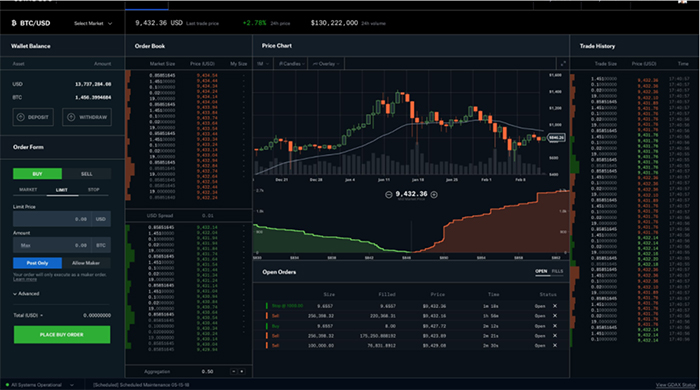

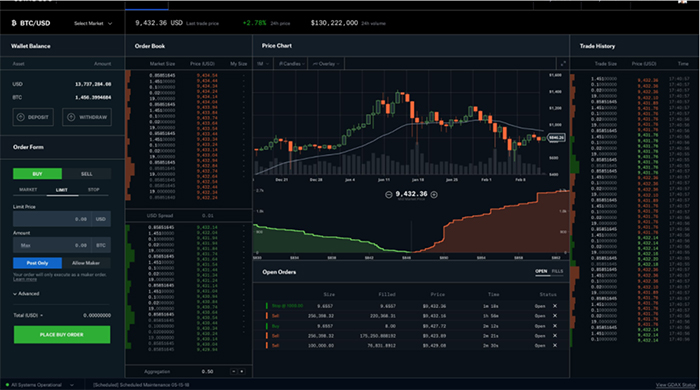

Desktop-based wallets, while still being hot wallets, are considered more secure than web-based wallets. Desktop wallets are downloaded to your computer, and access keys and passwords can be changed locally. Once installed, a desktop wallet can be accessed without internet access, which is an added level of security over a web-based wallet. Coinbase Pro, Huobi Pro, Gemini, and Trust wallet are among the most well-respected providers. Unlike web-based wallets, the provider is not a custodian of the Coin. All keys are stored directly on your computer.

Coinbase Pro Desktop wallet and centralized exchange interface https://developers.coinbase.com/docs/exchange/

Mobile wallets are apps that can be installed on your smartphone or tablet and are designed to easily send, receive, buy and sell coin using any smartphone. Paypal, the CashApp from Square, and Coinbase all offer mobile apps that make sending and buying coin incredibly easy. A mobile- based wallet offers the easiest access to your coin making it the easiest wallet for day-to-day purchases.

PayPal mobile wallet https://www.paypal.com/us/digital-wallet/manage-money/crypto

Cold Wallets

Cold wallets, also known as hardware wallets, are isolated from the internet and devices that connect to the internet, making them difficult for fraudsters to infiltrate with phishing or hacking attempts. Like the USB hardware wallet shown in the image below, an access code is entered using physical buttons on a device separate from your phone or computer. Some devices have extensive security features such as fingerprint scanners, retina scanners, or 2-factor authentication requiring a 2nd device. These features make a cold wallet the most secure way to store coin, and the preferred method for long-term storage of the bulk of your crypto assets. One feature to consider when shopping for a hardware wallet from companies such as Ledger, Trezor, and D'CENT, are password recovery methods. Some devices, if lost or damaged, cannot be recovered and the contents will vanish. Cold wallets should be kept secure in a safe or safety deposit box.

https://www.softwaretestinghelp.com/bitcoin-hardware-wallet/

Best Practices

Congratulations! If you've read through this far then you may be ready to get started. If you would like to spend a few hundred bucks on some coin, look at the web-based or desktop-based wallets offered by the centralized exchanges Coinbase or Gemini. They are U.S. based and their popularity works to your liquidity benefit from having a large client base and secure platform. If you want to use coin for day-to-day transactions or to exchange between friends and family, look for a mobile-wallet like CashApp or PayPal. If you have a significant amount of coin and you want to keep it safe and secure offline, look for a cold wallet that fits your needs. As digital currencies become a bigger part of our lives, you may find that you need access to every version of wallet and exchange to accomplish your goals. Always make sure you use unique usernames and passwords, 2-factor authentication, healthy skepticism, and an abundance of caution.

This article is a general communication for educational purposes only and not a recommendation by WTWM nor its advisors to either purchase or not purchase cryptocurrency. WT Wealth Management has not yet hitched our wagon to a specific cryptocurrency. Bitcoin and Ethereum currently have the greatest market value but that might not always be the case in the future. Our Investment Committee has “dipped the toe” into the cryptocurrency world by adding the centralized exchange Coinbase as a holding in our Culturally Significant Equities strategy. We have also partnered with IDX Digital Assets to offer risk-managed Bitcoin/Ethereum investments to our clients.

Trading cryptocurrencies carries a high level of risk – the classic risk versus reward scenario – and may not be suitable for all investors. Carefully consider your investment objectives, level of experience, and risk profile before investing in cryptocurrencies. No one should invest money in cryptocurrency that they cannot afford to lose.

Please speak to your financial advisor with any questions you may have. As always, we're here to help.