"

Diversification", "

compound returns", and "bond yield"... are a few phrases you may have heard from the world of finance. These fundamental concepts – simply the application of basic math principles – are critical to successful investing. This "Simple Math for Successful Investing" series aims to demystify the complex world of investing by using simple math concepts anyone can understand.

Our third installment will review the concept of "bond yield" and the math behind fixed income investments.

So You're Interested in Yield

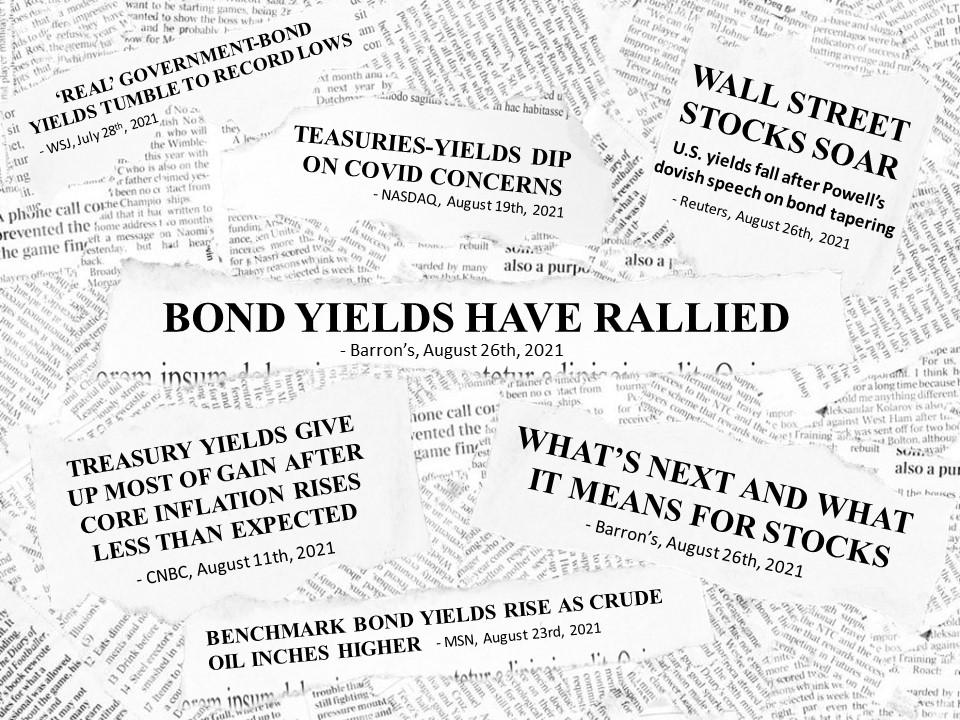

Figure 1 –Bond yields can be influenced by many facets of the economy, politics, and global events

You can't flip on CNBC or even open the market or business section of the newspaper without encountering a headline involving "yield". So, what exactly is "yield" and why is it so important to know its level and whether it is increasing or decreasing? Interest rates (a synonym for bond yields) are arguably the most important and impactful economic indicator in the economy. Beyond their direct relationship to bond prices, yields affect everything from mortgage rates to home prices, the stock market, business investment, government spending and finance, currency valuation, public policy, and the list goes on. Yields are even used as a barometer to assess the current and forecasted health of the economy. Pretty important! Each of these topics could warrant its own white paper, and perhaps we will write more about them in the future; however, for the purposes of this installment, we'll focus on the basics.

In its essence, yield is the cost of borrowing for a bond issuer and the return for lending for a bond purchaser. As we will see in the next section, yield is simply a different way of looking at a bond price. In fact, price and yield hold a direct inverse mathematical relationship. When rates increase, bond prices decrease. When rates decrease, bond prices increase.

Figure 2 – Bond price and yield are inversely related

Coupon and Principal and Price, Oh My!

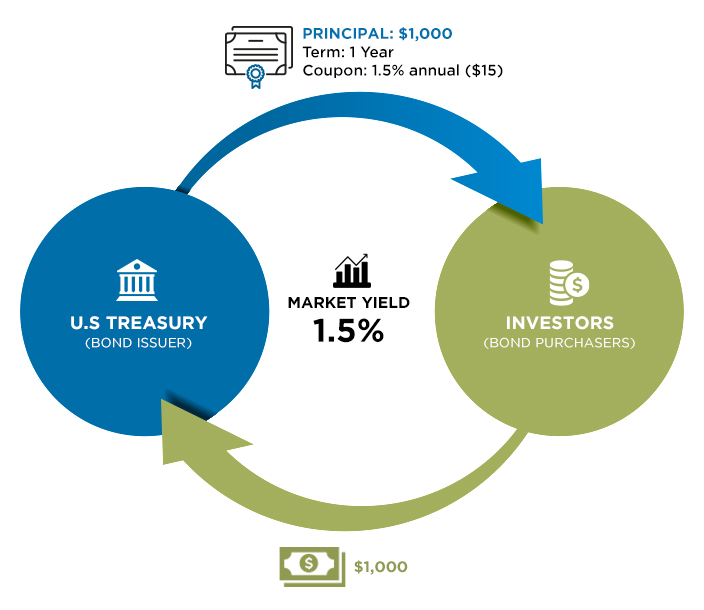

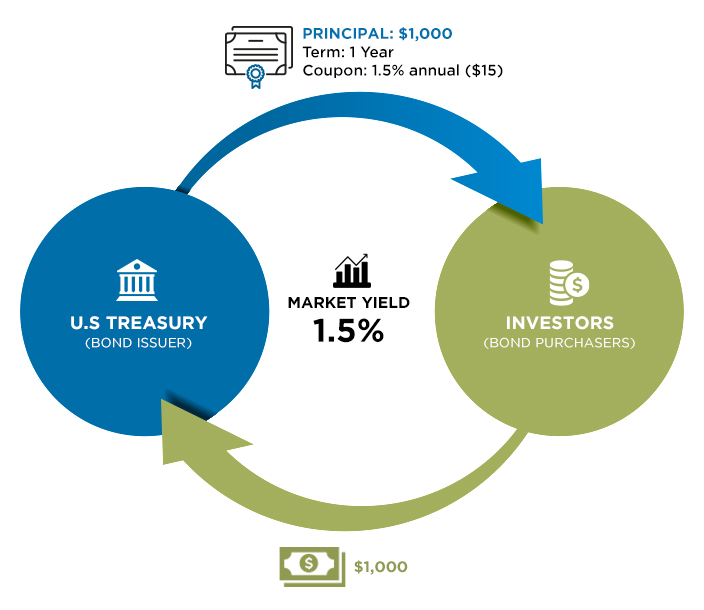

Before we dive into bond yield math, let's review the basics of a bond. A bond is a legal contract whereby a lender supplies an amount (principal) for a promise of repayment by the borrower at a future date, plus periodic interest (coupon) payments. Figure 3 below depicts the hypothetical exchange between the U.S. Treasury and investors in an issuance of one-year Treasury Bonds on February 14, 2020, when the one-year treasury yield was 1.5%.

Figure 3 – Exchange at issuance between bond issuer and purchasers when coupon equals market yield

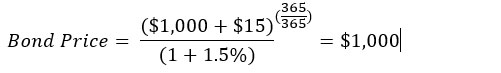

If the coupon equals the market rate of interest (yield), the price will simply be the principal amount. Let's do the math.

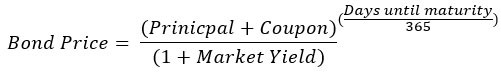

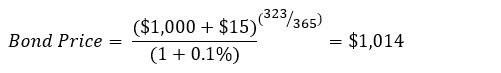

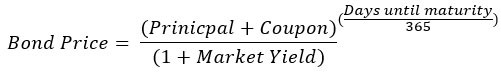

The equation to calculate the market price of the one-year Treasury Bond is as follows

1 :

Therefore,

At maturity, the February 14, 2020 U.S. Treasury Bond will pay back the principal ($1,000) and the coupon ($15), with the investor pocketing a 1.5% return (yield). Easy. But, as we learned from the news headlines, yields change. Constantly. So, let's see what happens to the price of the February 14, 2020 bond when the market yield changes.

Figure 4 below shows what happened to the one-year treasury rate during the onset of COVID-19, dropping from 1.5% on February 14th to 0.1% on March 27th, 2020.

Figure 4 – One-Year Treasury Yield during the onset of COVID-19 (February 14 – March 27, 2020)

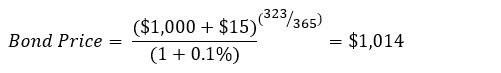

How did the precipitous drop in yield affect the price of the February 14, 2020 one-year U.S. Treasury Bond from the previous example? Let's review. The investor holds a bond that obligates the U.S. Treasury to pay 1.5% or $15 at maturity regardless of market yield. If a new Treasury Bond were to be issued on March 27th, it would only pay 0.1%, or $1 at the same maturity. Both bonds still repay the $1,000 principal. Which bond would you rather have? You'd prefer the bond that paid more of course! And so would other investors. In fact, other investors might pay more than the $1,000 principal value for the February 14, 2020 U.S. Treasury Bond because of the higher coupon payment. How much more? We can use our handy bond price equation to figure that out.

Voila! As market yield dropped from 1.5% to 0.1%, the price for the bond that was issued on February 14, 2020 increased from $1,000 to $1,014.

2

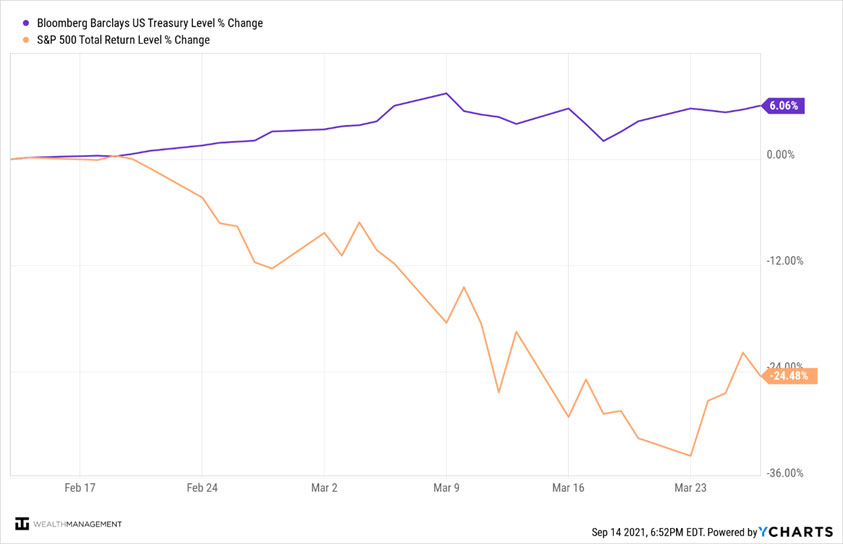

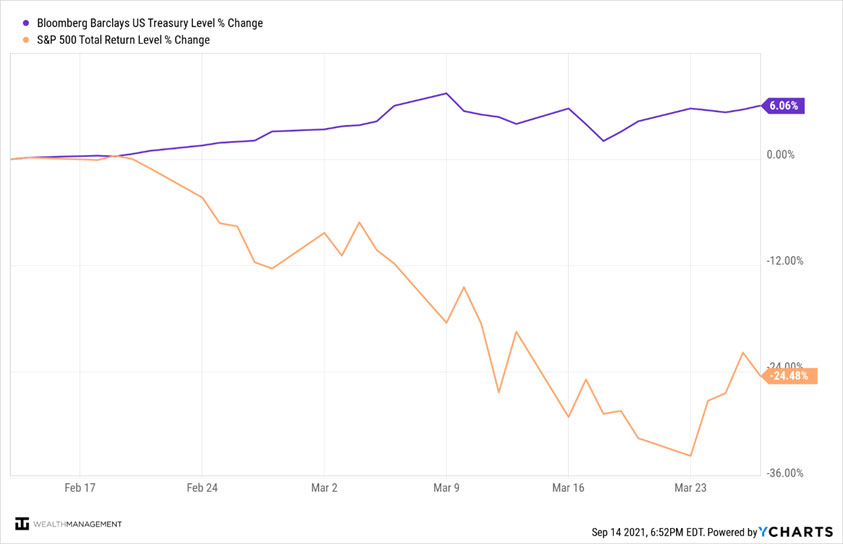

Therein lies the magic of bonds in diversifying your portfolio. Stocks and bonds tend to be negatively correlated, meaning if bond prices increase, stock prices decrease, and vice versa. Indeed, Figure 5 below shows the performance of stocks and bonds during the six-week period (February 14th to March 27th, 2020).

Figure 5 – Performance of U.S. Treasuries and the S&P 500 during the onset of COVID-19 (February 14 – March 27, 2020)

During the period, Treasury Bonds increased 6.06% while the S&P 500 lost -24.48%, a 30%+ spread in six weeks! If your portfolio had a bond allocation, you likely had some buffer from the market drawdown.

Knowing When to Yield

Constructing diversified portfolios with the right mix of stocks, bonds and other asset classes to meet your risk tolerance is key to the investment philosophy for our professionals here at WT Wealth Management and a regular focus of discussion on the Investment Committee.

To learn more about the investment philosophies we employ to help you achieve your financial goals, please visit our

website or reach out to your financial advisor.

NOTES:

1 Or you can use a simple online calculator such as this:

Bond Value Calculator: What It Should Be Trading At | Shows Work! (free-online-calculator-use.com)

2 Note, in this example interest rates dropped 1.4% and the value of the bond increased by the same amount ($14 or 1.4%). This is not always the case. The actual change in the bond price for a given change in yield is a function of the time until maturity and amount and frequency of interest payments. This characteristic is quantified by two terms called duration and convexity, which are outside the scope of this article. However, understanding the general concept of changes in yield on bond prices as we have outlined here will give you a good starting point.